Japan is already Spring's largest market and accounts for around a third of the group's total international seat capacity (according to CAPA - Centre for Aviation and OAG data for the week commencing 15-Jul-2019). It currently has 19 routes connecting China and Japan, including five routes that are operated by its Japanese affiliate.

Spring Airlines chairman Stephen Wang told CAPA on the sidelines of the 4-Jun-2019 Airline CEOs in Seoul Summit that the group aims to grow rapidly in the China-Japan market using both Spring Airlines China and Spring Airlines Japan.

"Previously China-Japan has some problem politically but it looks like this problem is getting solved," Mr Wang said in a CAPA TV interview. "We look forward there will be more traffic in the future." He added: "Japan is a very important destination for Chinese tourists … The Japan product is very welcome for Chinese tourists. I think we try to send more passengers to Japan and also let the Chinese passengers know better of Japan."

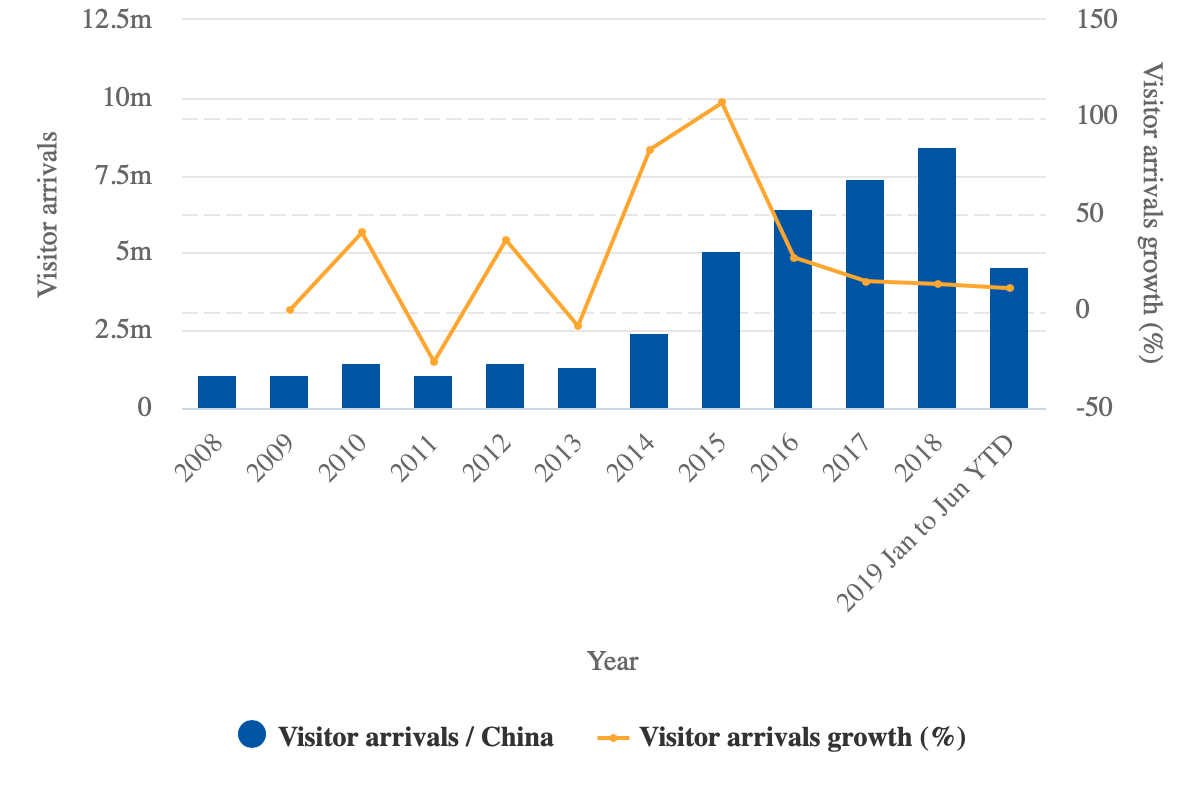

Japan became a hot market for Chinese travellers in the middle part of this decade, leading to a quintupling in Chinese visitor to Japan from 2013 to 2016 (from 1.3 million to 6.4 million). However, growth slowed to 15% in 2017 (to 7.4 million) and 14% in 2018 (to 8.4 million).

CHART - Chinese visitors to Japan were up a rather modest 12% in 1H2019 Source: CAPA - Centre for Aviation and JNTO.

Source: CAPA - Centre for Aviation and JNTO.

The slowdown came at an inopportune time for Spring Airlines Japan, which began international operations in early 2016. It was initially confined to the domestic market after launching on 1-Aug-2014.

For an LCC that is about to turn five years old, Spring Airlines Japan is very small. It has a fleet of only six aircraft and has just eight routes. It currently connects Tokyo Narita with five cities in China - Chongqing, Harbin, Ningbo, Tianjin and Wuhan - and operates domestic services from Narita to Hiroshima, Saga and Sapporo.

Spring Airlines China does not serve Narita; its 14 routes to Japan include six to Osaka, three to Nagoya, one to Ibaraki, one to Saga, one to Sapporo, one to Takamatsu and one to Tokyo Haneda. Seven of these routes are from Spring's main base at Shanghai and the other seven are spread across seven other Chinese cities (Dalian, Guangzhou, Hefei, Ningbo, Shenzhen, Xian and Yangzhou).

The group currently has around 17,000 weekly one-way seats in the China-Japan market, including approximately 12,000 operated by its Chinese subsidiary and 5,000 seats operated by its Japanese affiliate. During peak periods Spring's capacity to Japan exceeds 20,000 weekly one-way seats due to seasonal flights operated by the Chinese subsidiary.

Its share of total China-Japan capacity is currently only 7%. However, Spring is by far the largest LCC competitor. The other five LCCs serving this market (Beijing Capital, China United, Jetstar Japan, Lucky Air and Peach) combined have less than a 3% share. The LCC penetration rate should clearly be a lot higher than the current 10% given this is a short haul market with an average flight time of around three hours.

Spring does not plan to launch any other overseas JVs as it continues to focus on its Japanese affiliate and the China-Japan market. "Japan is Spring's first JV," Mr Wang said. "We will play our primary attention to Spring Japan."

Spring Japan has always been viewed as a platform the grow the group's presence in the China-Japan market and carry more Chinese to Japan. While the inbound segment is also important, it is much smaller (there were 2.7 million Japanese visitors to China in 2018), it has shrunk by nearly 30% since the beginning of this decade and consists mainly of business passengers. Spring is confident there is sufficient outbound demand to connect a lot more of the nearly 70 Chinese cities in its network with increasingly popular Japanese tourist destinations.

HEAR MORE… Spring Airlines chairman Stephen Wang discusses expectations for fleet and traffic growth in 2019, plans for expanding its Japanese affiliate, the recent launch of services to Myanmar and the initial performance of the A320neo fleet in this exclusive interview filmed on the sidelines of the CAPA Airline CEOs in Seoul Summit in early Jun-2019.