It is a fragile situation for an already battered industry and another decline in weekly global flight frequencies is no surprise. Encouragingly, the rate of decline has slowed on last week's levels. CTC - Corporate Travel Community analysis of OAG schedule data for the week commencing 26-Oct-2020 shows that global flight frequencies have declined -1.6% with the loss of nearly 6,500 departures than the previous week.

Total global weekly departures slip from just under 395,500 to less than 389,000, the lowest weekly level since the week of 13-Jul-2020. This brings the loss of flight frequencies since the peak of the recovery in the week commencing 17-Aug-2020 to 25,000, a -6.0% reduction.

It is a mixed global performance this week, but again the week-on-week falls are dominated by the largest current aviation economies of North America (-4.3%), North East Asia (-2.1%) and Western Europe (-5.1%) where together more than 9,500 weekly flights have been cut out of each region's schedules.

Central and Eastern Europe (-8.4%) again sees flight levels decrease by more than 1,000 and the largest week-on-week percentage decline, but Central Asia (-4.0%) is the only other region to see a reduction in frequencies this week. The rest of the world enters the northern winter with a growth in schedules.

The rises are led by South Asia (+8.9%), while South East Asia (+6.0%) joins it in growing by just over 1,500 weekly frequencies. Strong growth rates are also being seen in Upper South America (+7.7%) and the Caribbean (+7.7%) as both regions start to see signs of recovery.

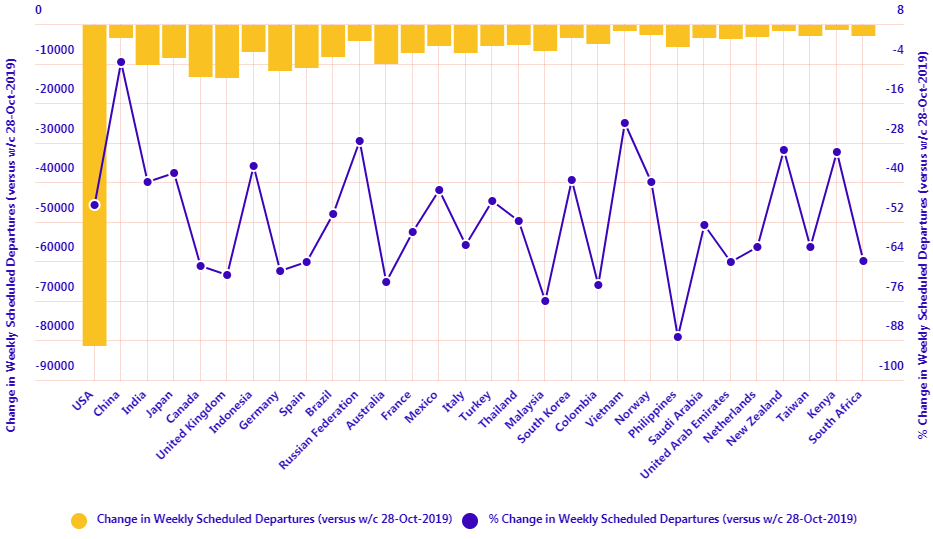

India edged ahead of Japan to be the world's third largest aviation market by flight departures with a +8.8% week-on-week rise last week and follows it with a larger +10.3% rise this week as over 1,400 additional frequencies are added. USA departures (-4.8%) slip to just above 90,000 for the week, while China falls just below that level (-2.5%). The Russian Federation sees further declines (-8.5%), while Turkey's frequency reduction (-7.8%) sees it slip outside the ten largest aviation markets for the week and replaced by United Kingdom (-0.3%).

Vietnam (+15.2%), Malaysia (+27.1%) and Myanmar (+15.4%) all report double-digit week-on-week growth and Greece (-19.0%), Portugal (-10.7%) and Ukraine (-15.2%) double-digit declines among the top 50 markets by departures this week, while Oman (+104.3%) and Trinidad & Tobago (+155.2%) are among those showing the largest rises among the rest of the ranking.

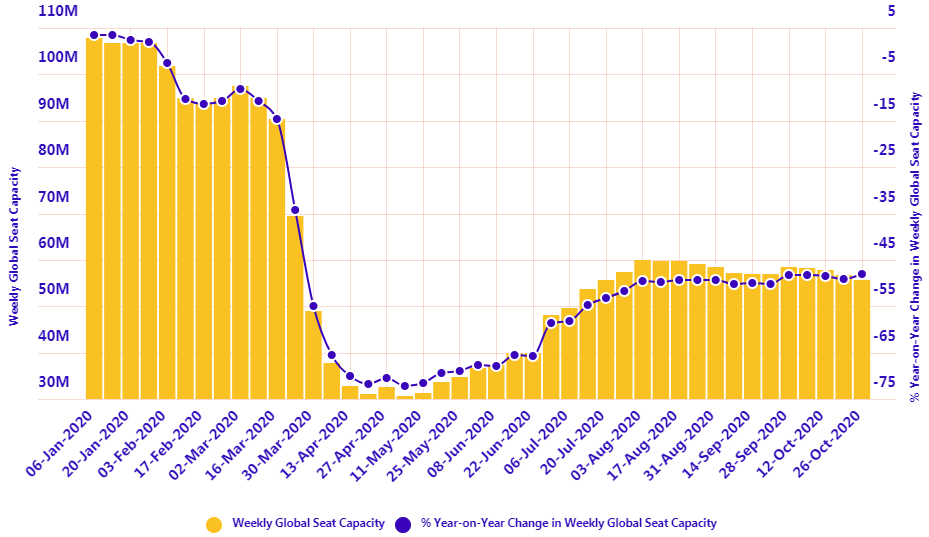

Last week's -2.0% and -2.1% declines in flight frequencies and seat capacity, respectively, had a notable impact on year-on-year performance levels. This week's slightly more modest declines of -1.6% and -1.8% actually show a positive movement in year-on-year comparison and suggest seasonality rather than COVID-fuelled demand reductions are the reason for the movement.

Flight frequencies are down 'just' -45.8% year-on-year, a +1.2 percentage point improvement on last week, while capacity levels are down -48.1%, a +1.0 percentage point improvement on last week. The seat reduction is the strongest year-on-year performance since the last week of the previous 2019/2020 northern winter schedule back in the week commencing 23-Mar-2020 when the global air transport industry was in freefall.

After a forgettable summer it is a positive opening to what is certain to be one of the toughest winters ever for air transport. Let's hope we can retain this level of positivity over the next five months and look forward to summer 2020 with a little more optimism.