The rollout of the vaccine and its impact on aviation will be significant, but it will take some time. It has delivered a more optimistic outlook already though and the impact on consumer confidence is already being seen with airlines seeing a rise in forward bookings.

While news of the successful development of multiple vaccines is positive, the reality is it just represents more optimism for the medium-term at best. Informa Group CEO Stephen Carter says the impact of vaccine rollout "isn't going to be like turning on a light switch", adding projections for 1H2021 are "complicated" while more stability may be expected from 2H2021.

Lord Carter also noted the potential for strong market activity from 2022, despite economic headwinds, stating: "There's a lot of pent up demand… There are very real, factual data points that would make you feel positive about where 2022 and 2023 could be." But by then the marketplace could look very different.

Highlighting an OECD warning, CAPA - Centre for Aviation chairman emeritus Peter Harbison says the "median advanced and emerging market economy could have lost the equivalent of four to five years of per capita real income growth by 2022". This, he says, illustrates a "lot about what the purchasing power is going to be of likely consumers of the aviation product".

As such, he believes it will be "hard for airlines to get back", and the IATA projections for future cash burn mean the industry "can't just continue to hold our breaths and hope" that the COVID-19 pandemic is going to go away".

Mr Harbison believes the industry "can't rely on the vaccine as the saviour for the industry" and notes there must be "some strong interim capability of allowing people to travel between nations" before the vaccines become fully effective. While the rollout goals for the COVID-19 vaccine are "really very aggressive", he warns it is not expected to be "plain sailing" especially when "we're looking at really big second or third or even extended first waves occurring in America particularly and in Europe.

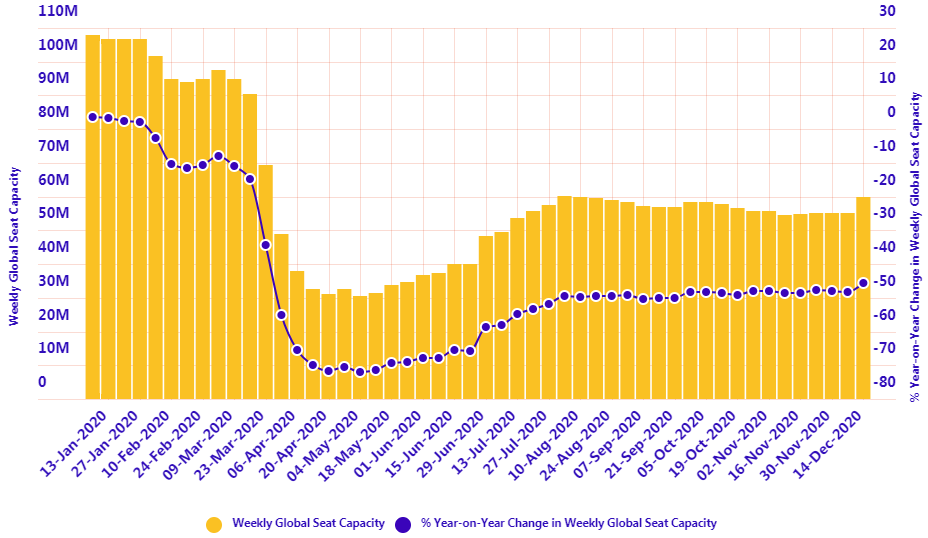

But let's look at the very surprising positives. This week we see global flight frequencies unexpectedly hit new heights up +1% over the previous high recorded back in Aug-2020. CTC - Corporate Travel Community analysis of OAG schedule data for the week commencing 14-Dec-2020 sees global flight frequencies rising +8.1% with the addition of over 31,000 departures when compared to last week. Total global weekly departures increase to almost 417,500 after the second highest week-on-week rise of the year.

There are rises in almost all regions of the world with Eastern Africa (-1.9%) and North East Asia (-0.6%) the only to see declines. Western Europe sees flight frequencies up a third (+33.5%) with almost 11,000 additional departures this week. North America exceeds its Atlantic counterpart in volume, up 11,500, a +11.4% rise. Central and Eastern Europe (+15.3%), North Africa (+15.2%) and the Caribbean (+11.8%) all see double-digit week-on-week rises in departures.

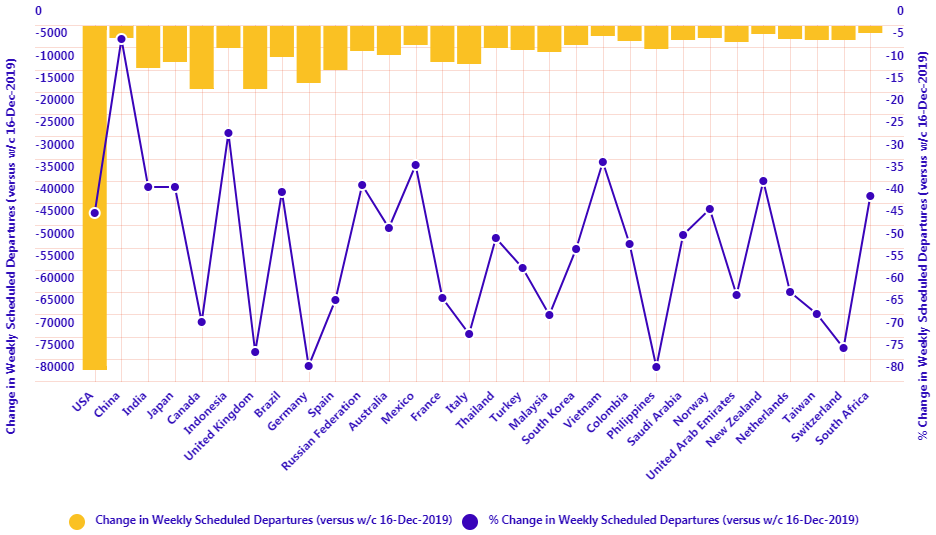

At a country level there are strong week-on-week rises across much of Western Europe, but Russian Federation (+1.9%) still remains the only nation that is among the world's ten largest country markets by departures. Within this grouping four see double-digit week-on-week rises: USA (+11.2%), Mexico (+10.9%), Australia (+12.2%) and Canada (+13.8%). However, China (-0.6%) and Japan (-1.0%) both see small declines.

Just outside the top ten we see the return of flight frequencies across the Western Europe giants. Spain (+26.5%), France (+82.6%), United Kingdom (+44.7%), Germany (+33.2%) and Italy (+64.7%) are now firmly back among the world's top 20 country markets by departures.

Elsewhere, Malaysia follows its +61.9% growth last week with flight frequencies up another third (+34.3%), while Myanmar continues a topsy-turvy trend: after departures doubled (+101.7%), then reduced by half (-53.8%), they are up more than three quarters this week (88.8%).

Netherlands (+33.1%), Portugal (+41.0%), Philippines (+15.9%), Puerto Rico (+14.6%), Sweden (+23.5%), Greece (+30.3%), Switzerland (+69.3%), Poland (+71.3%), Morocco (+38.5%), Denmark (+30.8%), Romania (+44.7%), Belgium (+46.2%), Argentina (+23.7%), Austria (+65.4%) and Republic of Ireland (+74.4%) are among the many markets with double-digit week-on-week growth. Oman (-45.5%), Bahrain (-12.2%) are among the few to see double-digit week-on-week declines.

This week's +8.1% increase in flights and +8.7% rise in capacity means year-on-year performance takes a big improvement step. This week, flight frequencies are down -43.5%, a +2.6 percentage point improvement on last week, while capacity levels are down -45.6%, a 2.8 percentage point rise on last week.

Despite many unknowns and uncertainties, there are reasons to be cheerful when it comes to vaccine progress and logistics. This week's schedules also provide a uplift in optimism. We are seeing the beginning of vaccinations and this is an important first step, but it is a long climb before we can effectively manage COVID-19 infections on a global scale. While mass vaccination programmes will likely be commonplace from 2Q 2021 it is estimated that it won't be until the end of 2022 that everyone in the world that wants a vaccine, will get one and that means challenges will remain.