Right now the industry remains relatively flat with the positive gains in one part of the world being balanced by notable declines in another as countries each face different stages in the fight against coronavirus. We could talk positively about the continued revival of North America, then we could talk about the continued collapse of European connectivity. Perhaps sitting in the middle is best.

CTC - Corporate Travel Community analysis of OAG schedule data for the week commencing 16-Nov-2020 shows that global flight frequencies have risen +0.4% with the addition of just under 1,500 departures on last week. Total global weekly departures rise to just over 386,000 having last week hit their lowest weekly level since the week of 13-Jul-2020.

It is Europe that headlines the declines as the second wave takes hold. Over 5,500 additional flights have been removed from schedules this week, the majority in Western Europe where levels are down -12.9% on last week. In Central and Eastern Europe the decline is more shallow at -6.3%, but still the second worst performing region of the world. Last week we reported that if you removed Europe from the analysis then flight levels were actually up +1.2%. This week the contrast is even higher, rising +2.1% if you remove Europe from the analysis.

Away from Europe things are a lot more positive with growth, albeit small in most cases across other regions of the world. North America leads the way with almost 4,700 additional departures this week, a +4.4% rise, ahead of North East Asia with over 1,200 more flights, a 1.1% rise. The Eastern (+7.4%) and Southern (+5.2%) regions of Africa lead in percentage terms, while Southwest Pacific sees an encouraging +3.3% rise.

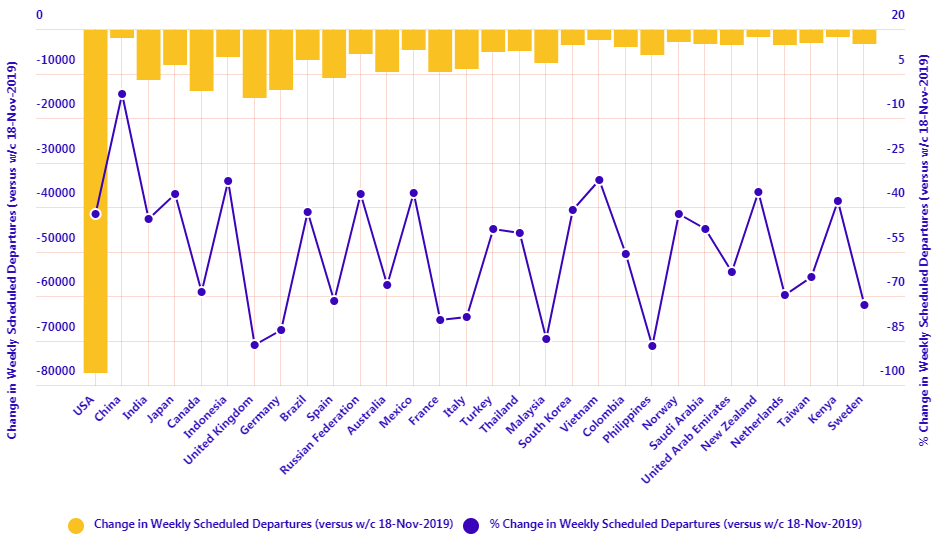

After weekly frequencies in the United States of America (USA) rose back above the 100,000 figure last week with a +4.1% week-on-week rise, a greater +4.7% rise this week sees that level rise beyond 105,000. It is a positive movement that sees the US market strengthen its position as the largest by departures, but it still remains a little way behind China in terms of capacity, a gap that is unlikely to be closed during 2020, based on recent trends.

The US leads the percentage growth among the ten largest aviation markets where flights levels see limited movement compared with last week. Across the wider top 30 country markets by departures solid growth has been recorded by South Korea (+8.8%), Tanzania (+20.1%) and South Africa (+7.6%).

The heaviest declines are across the major European markets, mostly evident in Italy and United Kingdom where flight levels have fallen by more than a fifth (-22.8%) and a quarter (-28.3%), respectively. The UK has now slipped to being the 25th largest market by departures as a four-week lockdown passes its mid-point.

Looking further down the list, notable growth markets this week are Trinidad & Tobago (+64.4%), Cuba (+24.6%) and Somalia (+84.3%), while Peru (+10.4%), Myanmar (+11.1%) and Venezuela (+11.3%) are among the small number of markets with double-digit week-on-week growth. Malaysia (-29.6%), Greece (-24.6%), Poland (-24.8%), Austria (-25.1%), Republic of Ireland (-32.7%) all see week-on-week declines of around a quarter or more.

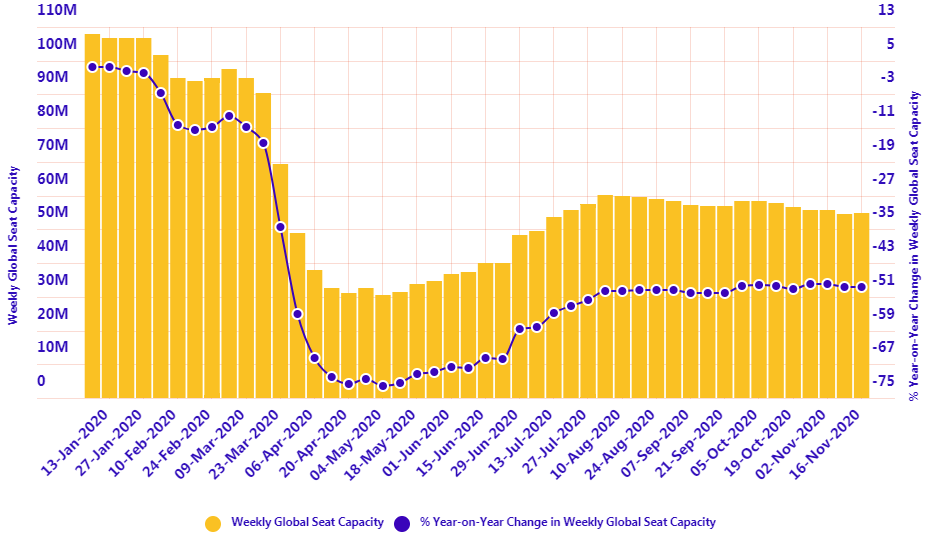

This week, flight frequencies are down -46.3% year-on-year, a -0.2 percentage point improvement on last week, while capacity levels are down -48.7%, no change on last week. While we have seen ups and downs over the past months it is a relatively stable global market right now and if Europe's lockdowns start to slow infection rates then there could be scope for flight levels there to increase in the latter weeks of the year and hopefully allow us to enter into 2021 with some positive momentum.