When it comes to global flight frequencies it is also the same story as last week - a relatively flat industry where any positive gains in one part of the world are being balanced by notable declines in another as countries each face different stages in the fight against coronavirus. The headline performers are the same too with a continued revival of flights in North America - this week supporting Thanksgiving travel - and the continued decline of European connectivity.

In fact, CTC - Corporate Travel Community analysis of OAG schedule data for the week commencing 23-Nov-2020 records exactly the same result as the previous week with global flight frequencies rising +0.4% with the addition of just under 1,750 departures on last week. Total global weekly departures rise above 388,000, a second successive week-on-week growth, but not enough to recover the -1.5% decline in the week commencing 09-Nov-2020. It means we will likely end Nov-2020 with less daily flights than we entered with, but only just.

Starting with the positives this week - and there are actually lots of them. Flight levels across much of the world see rises week-on-week, albeit at low rates. North America leads the way again with an additional 2075 weekly departures (+1.9%), while South Asia (+3.8%) and South East Asia (+2.9%) also see notable rises in departures. The Southwest Pacific sees the largest percentage growth (+4.4%) with weekly departure rising back above 10,000.

The declines - you guessed it - are dominated by Western Europe where governmental lockdowns are continuing to significantly reduce air travel. Flight frequencies are down a much slower rate in comparison to previous weeks (-5.5%) but still sees a reduction of more than 1,750 departures compared to last week. Since the first week of November, Western European schedules have reduced by a third (-33.4%) losing over 15,000 weekly departures.

Other regions showing negative performance this week are Southern Africa (-5.4%), Central America (-2.8%) and Eastern Africa (-1.6%), while North Africa (-0.5%) and North East Asia (-0.3%) see nominal reductions.

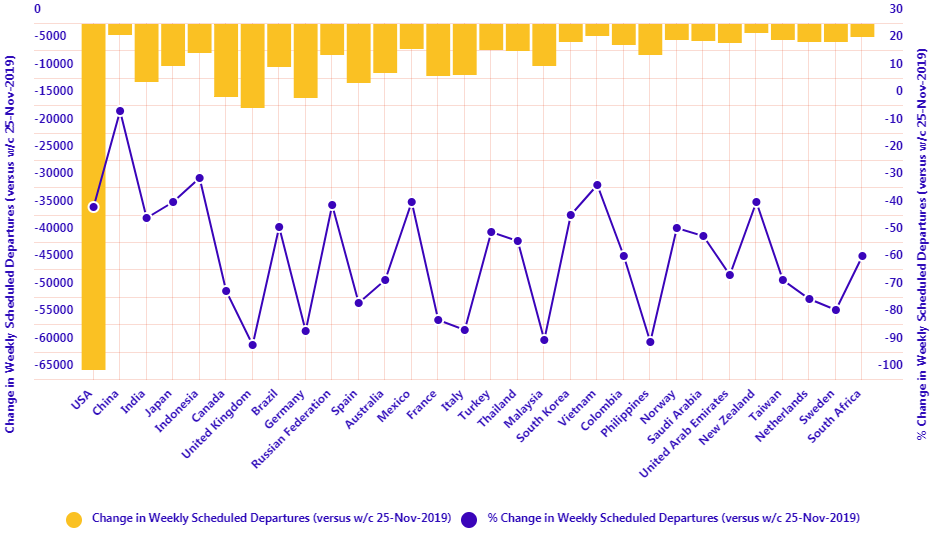

India (+4.7%) and Indonesia (+6.3%) are the strongest performers among the world's largest aviation countries by flight frequency, where the majority of markets are seeing growth in departures: the United States is the largest in scale with over 2,000 additional departures compared with last week.

Elsewhere, the return of domestic flights in Australia as internal state border restrictions have been eased has helped boost flights by +8.0%, the highest percentage raise among the current top 50 aviation economies, while the huge declines in departures among Western Europe's largest country markets have slowed this week, with the exception of Italy where flight frequencies have fallen by more than a fifth (-22.4%) versus last week

Looking further down the list and Romania (+15.4%), Greenland (+14.3%), El Salvador (+14.8%), Vanuatu (+23.2%), Hungary (+26.9%), Libya (+13.6%), Moldova (+30.8%) and Cambodia (+10.9%) are among the small number of markets with double-digit week-on-week growth. Belize (-17.7%), Ethiopia (-12.1%), Myanmar (-10.8%), Belgium (-11.2%), Zimbabwe (-15.8%), Malawi (-13.2%) all see double-digit week-on-week declines.

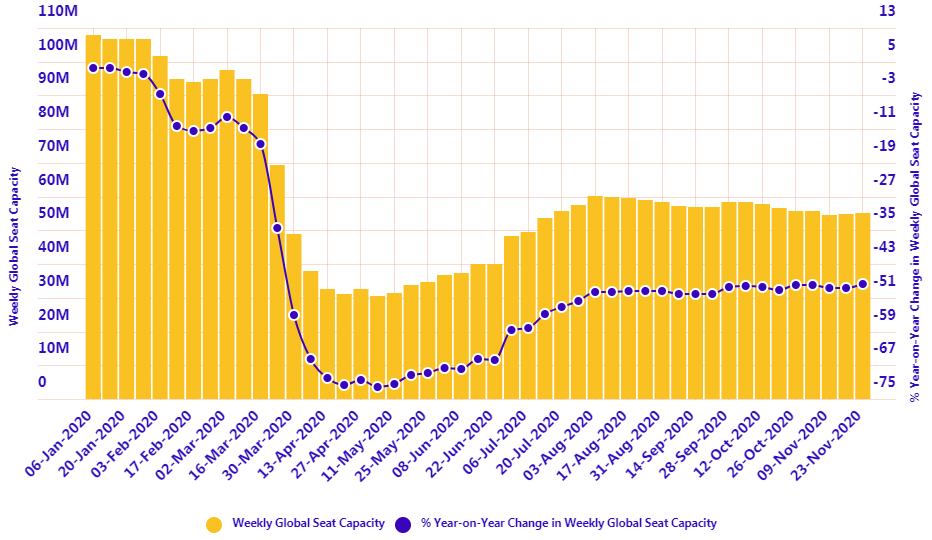

With such similarities to last week's performance you would expect year-on-year comparisons to follow the same trend, but that has not actually been the case and this week's schedules actually compares rather more favourably with last year's and seasonal changes. This week, flight frequencies are down "just" -45.2% year-on-year, a significant +1.1 percentage point improvement on last week, while capacity levels are down -47.7%, a +1.0 rise on last week.

The capacity performance represents the best year-on-year comparison since the end of Mar-2020 when global air travel was in freefall. It may be a flat week for so many other variables, but this is one that stands out positively and a perfect place to end this report.