Right now countries across the world are 'up' while others are 'down' as the pandemic passes through different stages of control. This week highlights that situation perfectly with significant increases in flight departures being recorded across South America as countries start to open up again, but notably declines across Europe as a second wave of infections take hold and we descend from the annual summer peak.

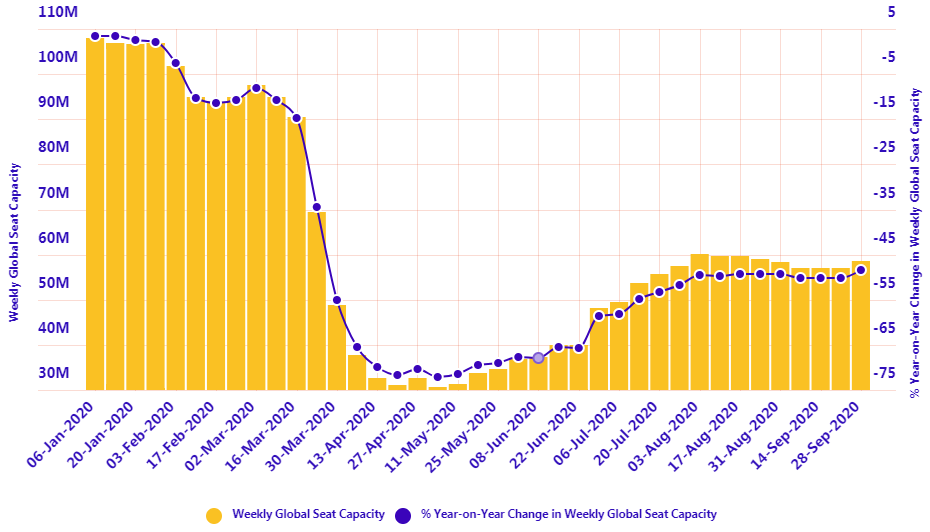

This week actually represents a key week for global air connectivity as we seemingly take another step up in the recovery. Let's focus on the positives - there are actually a number of them. After seven weeks of successive declines, the industry returns to growth and while levels remain down on the peak recovery weeks at the start of Aug-2020, year-on-year recovery levels are at their highest since the mid Mar-2020 slump.

We also see China's combined domestic and international capacity exceed last year's level, an uplift linked with the nation's 'Golden Week' holiday and its associated National Day, the 01-Oct-2020 holiday to commemorate the founding of the People's Republic of China.

Corporate Travel Community (CTC) analysis of OAG schedule data for the week commencing 28-Sep-2020 shows that global flight frequencies have risen +2.4% with just over 9,500 more departures than the previous week. Total global weekly departures rise from just under 397,000 to again exceed 400,000, reaching 406,500 and reversing three weeks worth of shallow declines.

Growth is seen across almost all geographies this week: the exceptions being Western Europe (-4.8%), Eastern and Central Europe (-2.8%) and Central and Western Africa (-0.5%). The big markets of North East Asia (+3.1%) and North America (+2.6%) see the largest week-on-week rises in flight frequency levels, but it is the Middle East (+9.2%), South East Asia (+9.1%), Central Asia (+8.7%), North Africa (+8.4%) that lead the percentage growth.

The continued emergence of air services across Latin America sees flight levels across the Caribbean and Central and South America grow +7.6% week-on-week, the largest concentration being in the Upper South America area where levels have grown by more than a third (+37.6%) with almost 1,000 additional weekly frequencies.

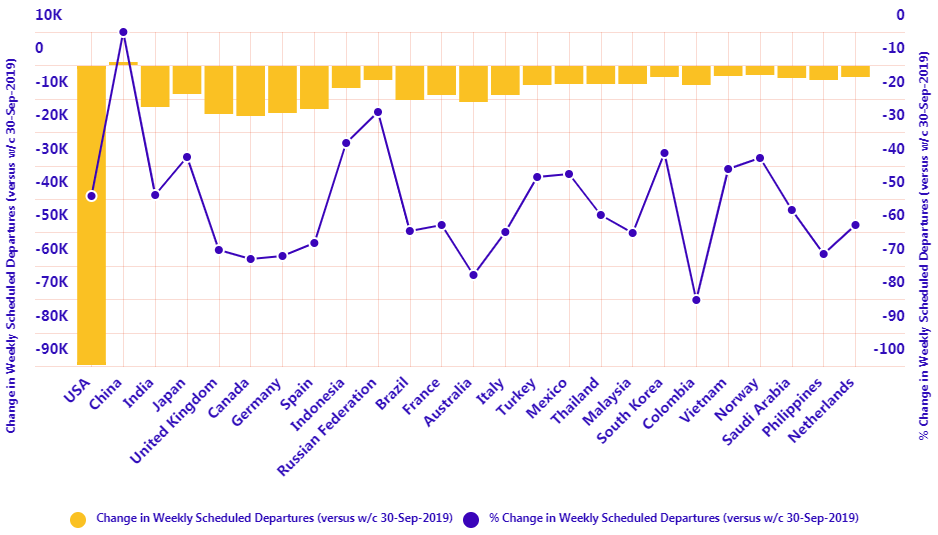

After a fairly stable performance last week among the world's leading aviation economies with only minor fluctuations in flights in either direction, there are more notable shifts this week. Six of the top ten aviation economies see week-on-week growth, with China and USA adding 3,200 and 2,500 additional flights to last week's total. Mexico returns to the top ten with the largest percentage growth, +4.7%, jumping this week ahead of Canada (+0.8%), Germany (-3.0%) and France (-9.1%).

The two European nations follow a declining trend that spreads among the major European aviation economies this week. United Kingdom (-5.1%), Spain (-7.4%) lead the declines among the top ten, while Italy (-8.7%) and Greece (-9.7%) are among those in the wider top 25 with the largest week-on-week declines.

Among the top 25, South Korea (+19.3%), Vietnam (+11.8%) and New Zealand (+15.0%) all record double-digit week-on-week flight frequency rises and there are some notable climbers this week as more nations start to rebuild air connectivity.

The Philippines (+120.7%), Bahrain (+104.2%), Oman (+110.9%) all see levels more than double; Algeria (+58.7%), Madagascar (+35.0%), Myanmar (+25.4%), Macau (+73.1%), Turkmenistan (+30.5%) and Uzbekistan (+68.3%) all see notable rises, while Colombia (+57.3%), Chile (+20.9%), Peru (+92.3%), Venezuela (+21.5%) lead the Latin recovery.

Large declines in departure levels are recorded in Costa Rica (-45.1%) and Namibia (-43.2%), while Croatia (-18.1%), Latvia (-16.8%), Malta (-12.9%), Lithuania (-10.3%) all see double-digit week-on-week declines.

Although flight and capacity levels have reduced over the past weeks this has had little impact on year-on-year performance and has followed what appears to be more seasonal trends. The rise this week in frequencies (+2.4%) and capacity (+2.8%) is not directly linked to seasonal trends though and shows a favourable improvement in year-on-year performance levels.

Looking at this parameter flight frequencies are down -46.5% year-on-year, a +1.5 percentage point improvement on last week, while capacity levels are down -48.3%, a 1.8 percentage point improvement on last week. Notably, they rise again above the -50% figure after three successive weeks below that level.

What next week will bring is far from clear. Advances schedules suggest a +2.8% rise in flights and +3.4% in capacity for the week commencing 05-Oct-2020 but we all know looking ahead is difficult with a regular culling of schedules still continuing even just a week ahead of departure date. If they prove true then we will be marking a new high in the recovery. Only this time next week will we learn if we are 'up', 'down' or like the Grand Old Duke of York nursery rhyme 'neither up nor down'.