If it wasn't bad enough that global air travel demand has collapsed due to the stringent travel restrictions that have been introduced to combat the spread of Covid-19, the airport, the gateway into India's West Bengal region was hit by Cyclone Amphan last month forcing its closure for a 36 hour period and causing some notable damage to its infrastructure.

It could have been a lot worse. Areas across Bangladesh and eastern India were devastated by the storm which left at least 96 dead and flattened homes, uprooted trees and left cities without power. The cyclone arrived with winds gusting up to 185km/h (115mph) and waves as high as 15ft. It is the first super cyclone to form in the Bay of Bengal since 1999, albeit thankfully its winds had weakened by the time it struck, seeing it classified as a very severe cyclone.

At Kolkata Netaji Subhas Chandra Bose Airport damage was reported to an aircraft hangar and flooding was seen in some facilities. Three aerobridges have now been taken out of operation for repair following damage from the cyclone.

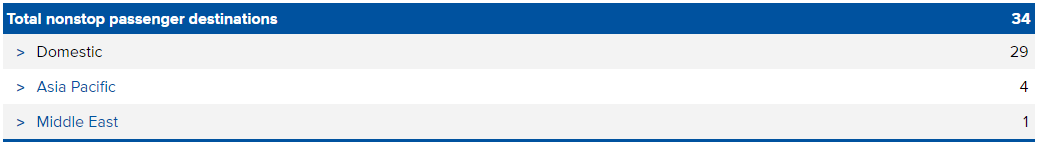

This all occurred just as the airport was looking to start building up its operations as India started to permit the return of commercial air operations. Last year the airport had handled 22 million passengers, up +3.9% year-on-year. This followed four successive years of double-digit annual growth, including a +26.9% rise in 2017. But, right now the airport is a shadow of its former self - on 01-Jun-2020 it passed a key milestone in its recovery handling 60 aircraft movements in a single day.

NETWORK MAP (as at 22-Jun-2020)

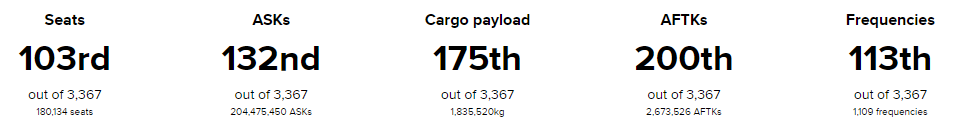

GLOBAL RANKING (as at 22-Jun-2020)

DESTINATIONS (as at 22-Jun-2020)

ANNUAL PASSENGER TRAFFIC (2010-2020YTD)

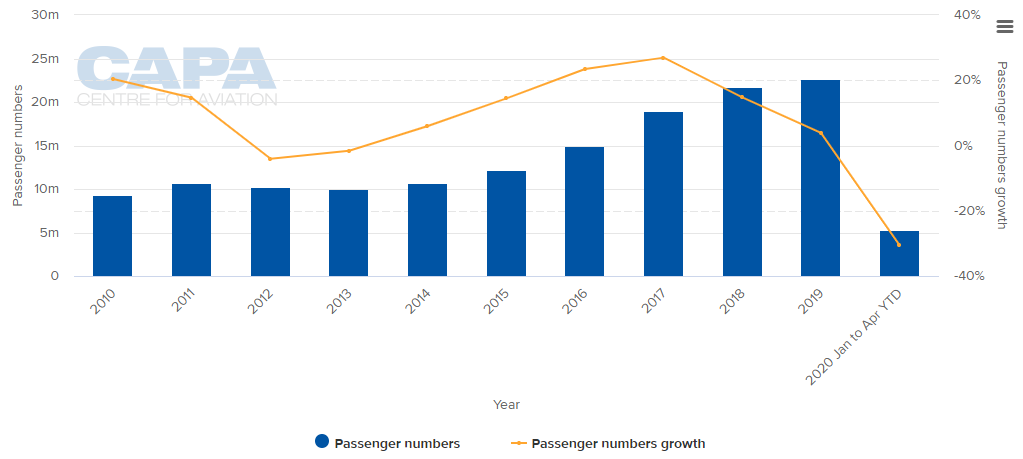

ANNUAL CAPACITY (2012-2020*) (NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

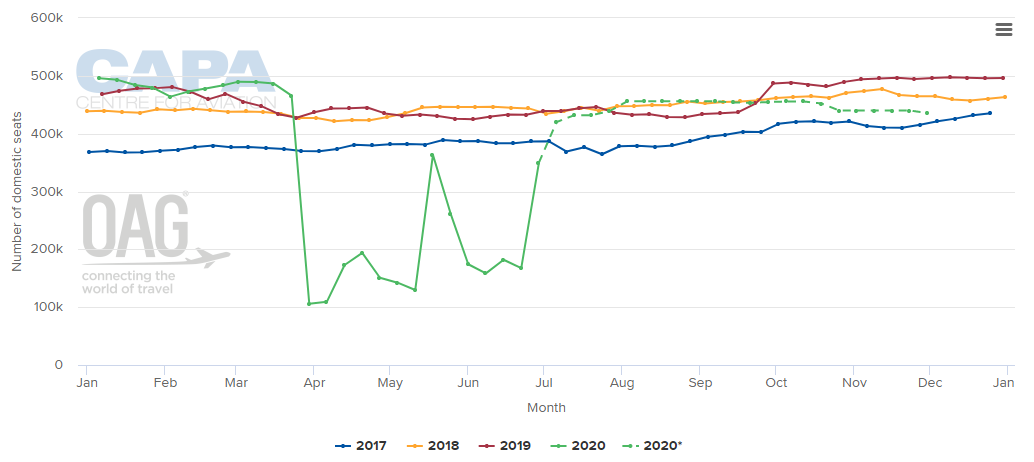

WEEKLY DOMESTIC CAPACITY (2017 - 2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

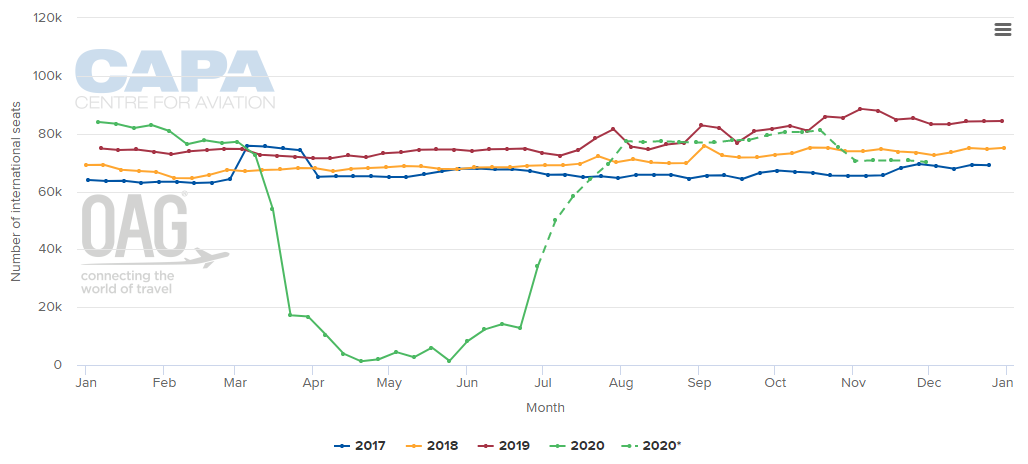

WEEKLY INTERNATIONAL CAPACITY (2017-2020*) NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

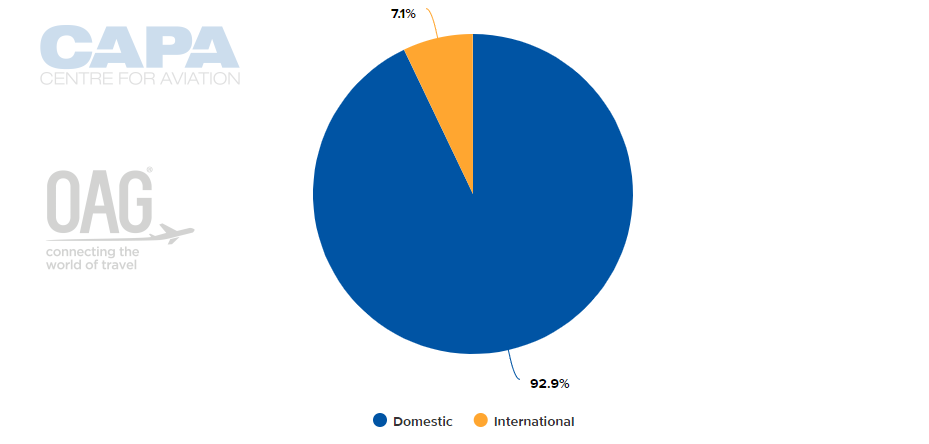

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 22-Jun-2020)

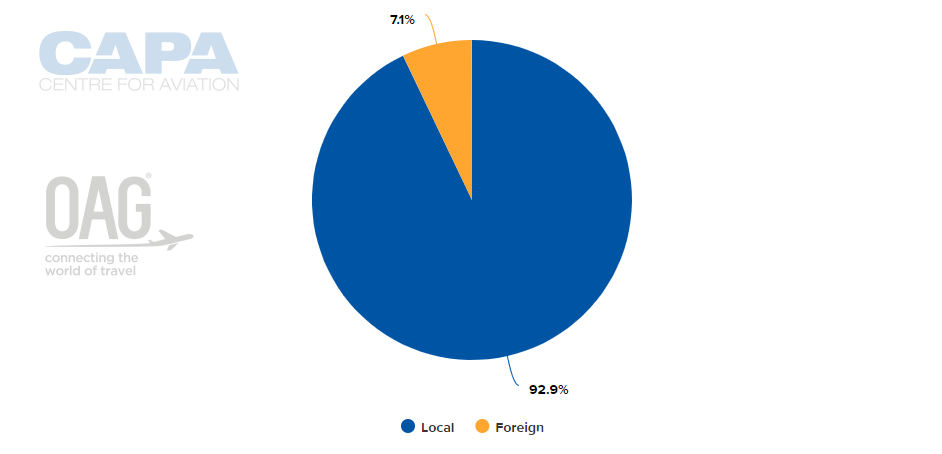

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 22-Jun-2020)

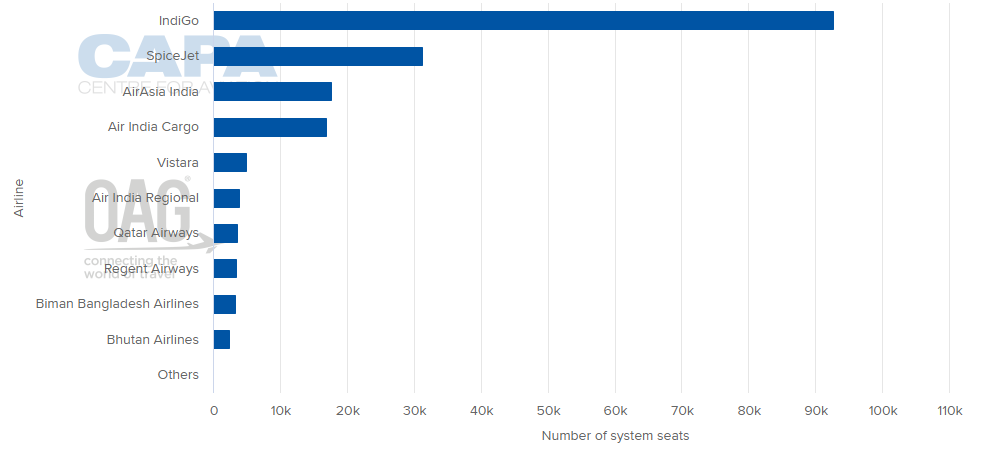

LARGEST AIRLINES BY CAPACITY (w/c 22-Jun-2020)

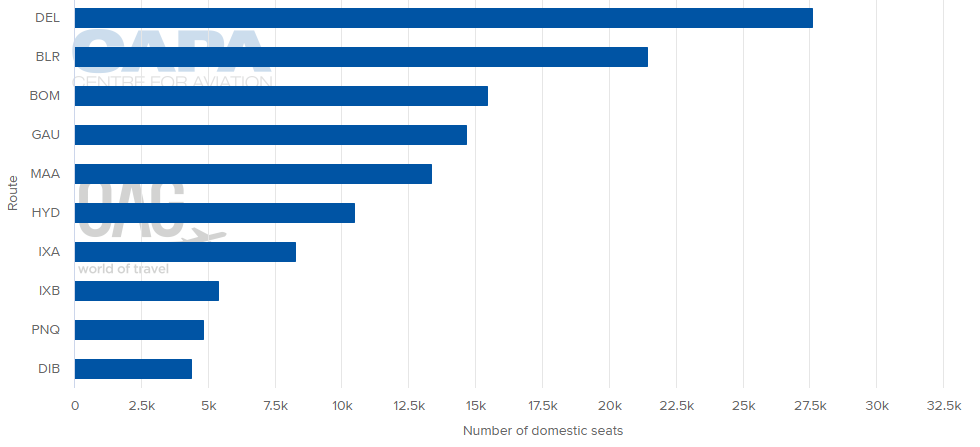

LARGEST DOMESTIC DESTINATION MARKETS (w/c 22-Jun-2020)

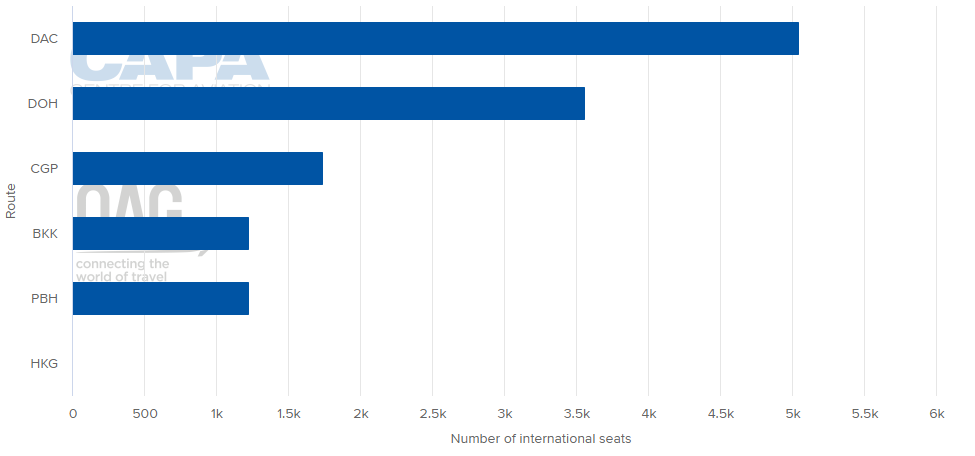

LARGEST INTERNATIONAL DESTINATION MARKETS (w/c 22-Jun-2020)

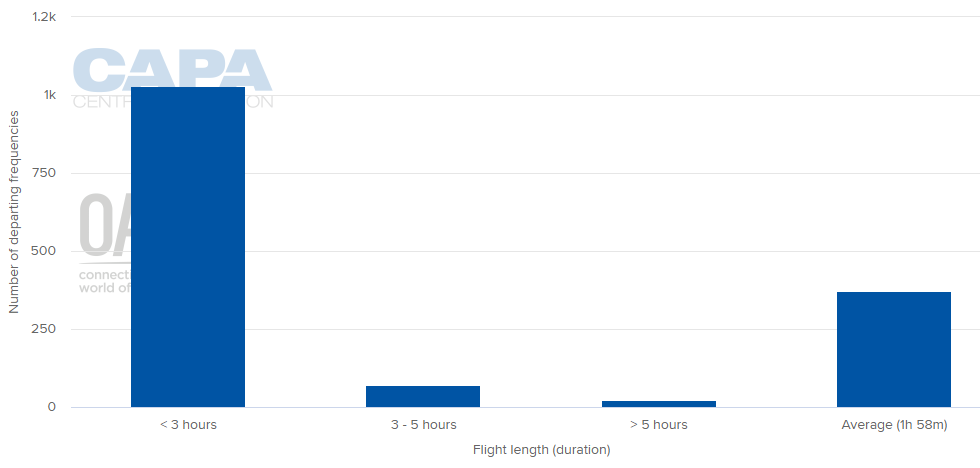

AVERAGE FLIGHT LENGTH (w/c 22-Jun-2020)

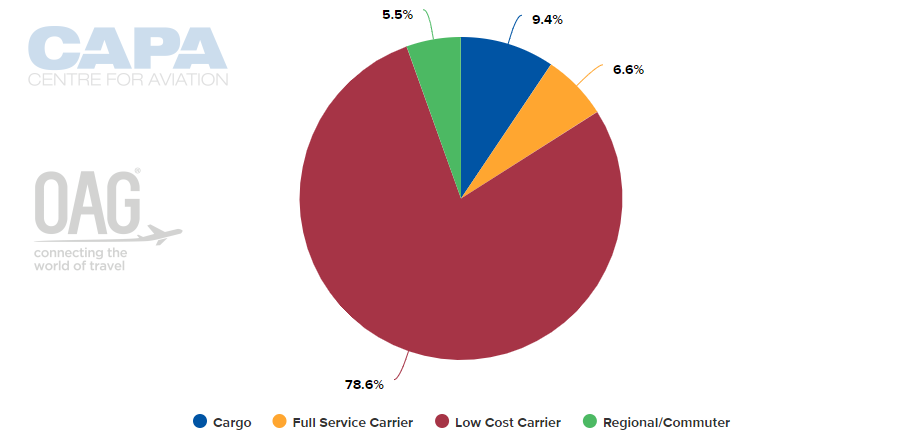

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 22-Jun-2020)

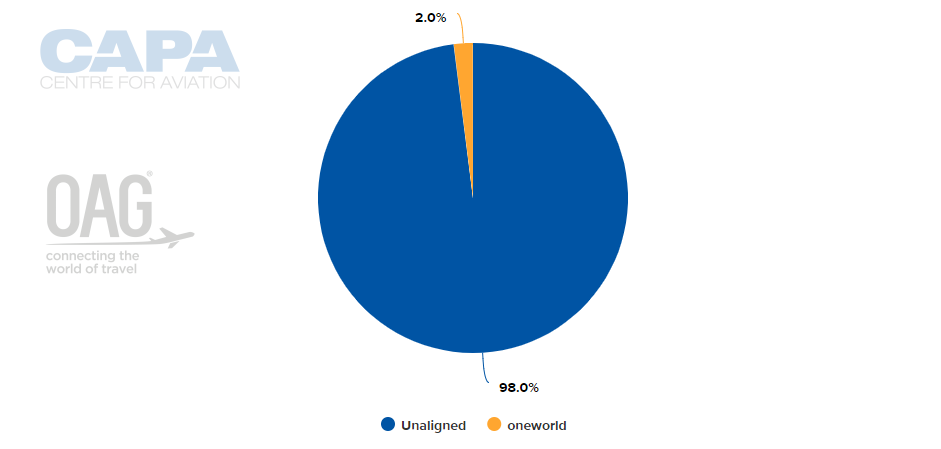

ALLIANCE CAPACITY SPLIT (w/c 22-Jun-2020)

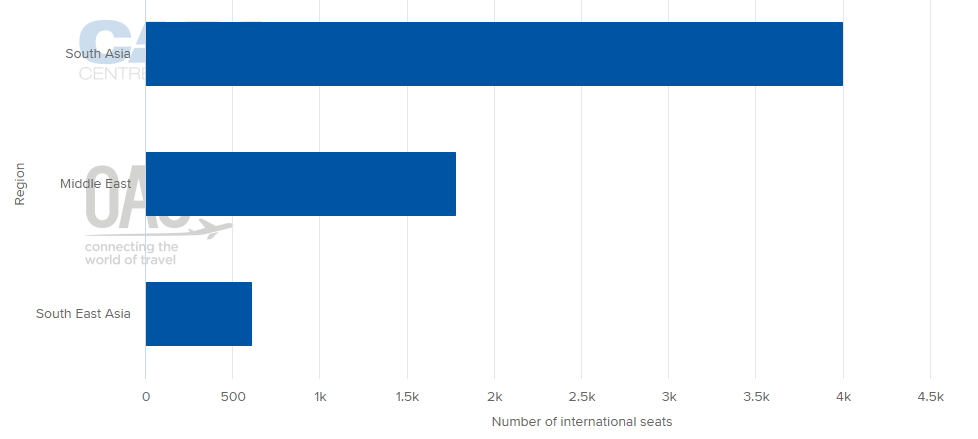

INTERNATIONAL MARKET CAPACITY BREAKDOWN BY REGION (w/c 22-Jun-2020)

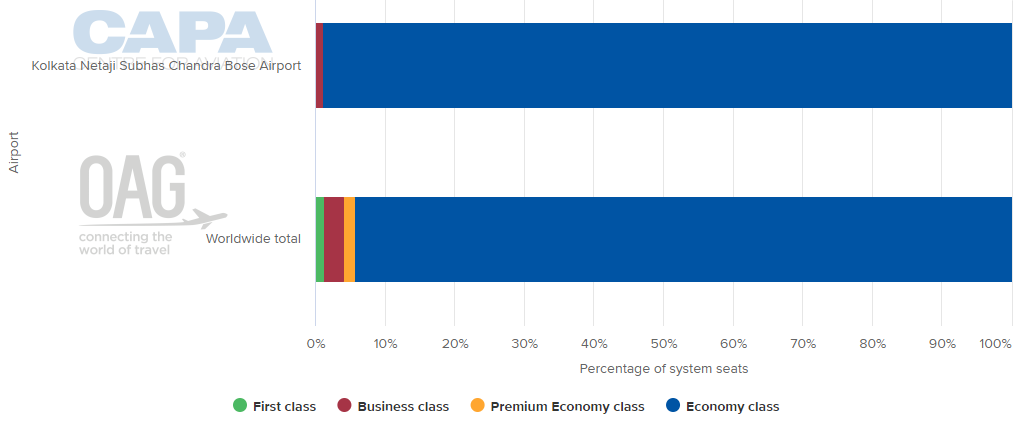

DEPARTING SYSTEM SEATS BY CLASS (w/c 22-Jun-2020)

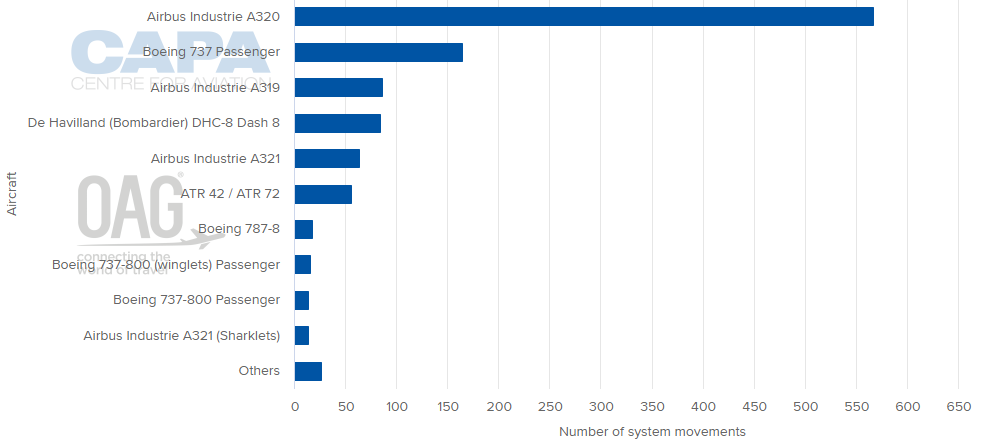

AIRCRAFT OPERATIONS BY MOVEMENTS (w/c 22-Jun-2020)

MORE INSIGHTS...

Indian government adds six more AAI airport privatisations