Famed for pristine beaches and turquoise waters, the Maldives' 1,192 coral islands are scattered in ring-like chains across the equator, while the country's 156 upmarket resorts, which make up the backbone of the tourism sector, are located on private islands, an exclusivity that is perfect for social distancing.

This has helped the country to perhaps take a more relaxed approach in the Covid-19 world opening its doors to anyone in Jul-2020. A policy described as "courageous" and also "a little bit crazy" by tourism experts it was a decision that was vital to recovery for the small nation's economy.

"The Maldives needs tourism," Abdulla Mausoom, the Maldives' tourism minister has been quoted as saying by international media. "When tourism stops, everything stops. We have no choice but to carry on."

Individual resorts are still requiring guests to complete tests on arrival and hygiene protocols are in place throughout the country to minimise any potential virus spread. But the government's 'open for business' sign provides the clear guidance that many travellers are seeking to gain book travel.

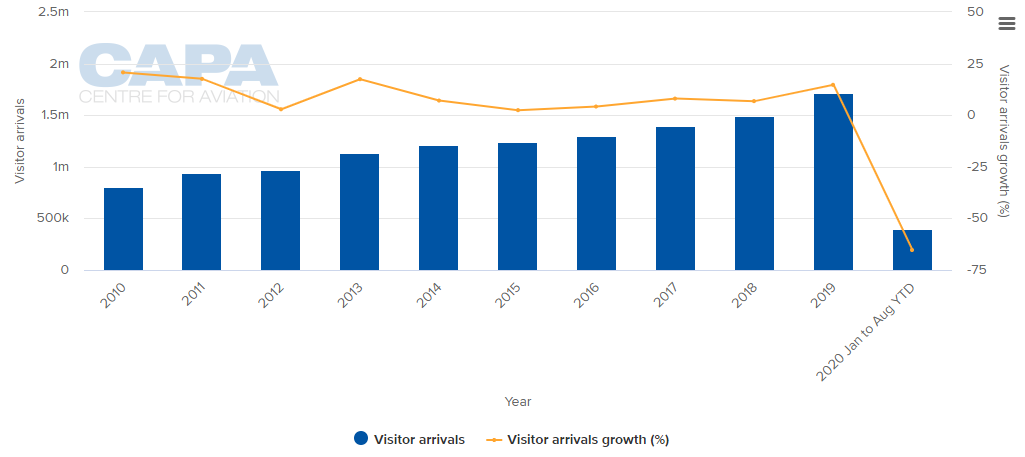

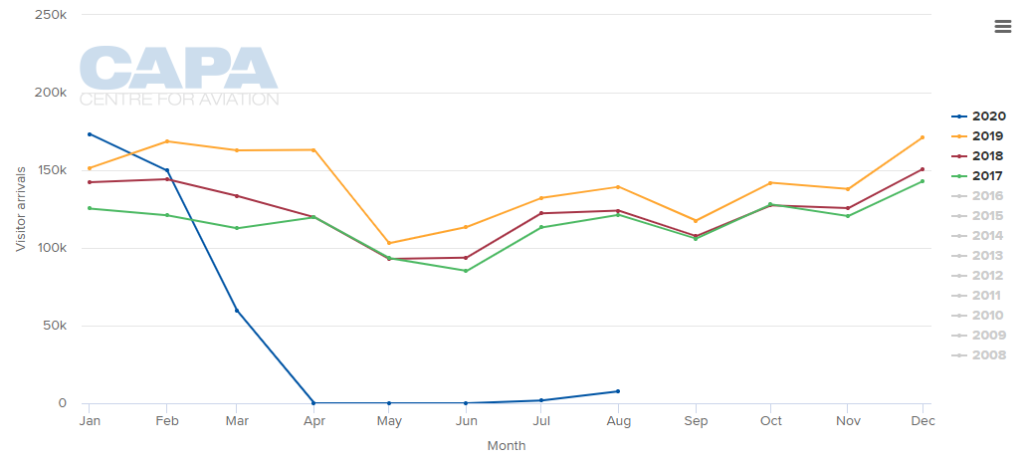

There are initial signs of positivity. From no international arrivals, levels moved up to 1,752 in Jul-2020 and then to 7,628 in Aug-2020, but this remains markedly down on the almost 140,000 arrivals the same month last year. This remains a huge issue with the country among the worst hit globally by the decline in international travel, a devastating impact on the Maldives' economy, halving government revenue, forcing thousands of people out of work and putting pressure on the value of the Maldivian rufiyaa. Tourism accounts for more than two-thirds of the Maldives' GDP and the World Bank estimates its economy could shrink by nearly -9% this year.

AIRPORTS IN THE COUNTRY

ANNUAL VISITOR ARRIVALS (2010 - 2020YTD)

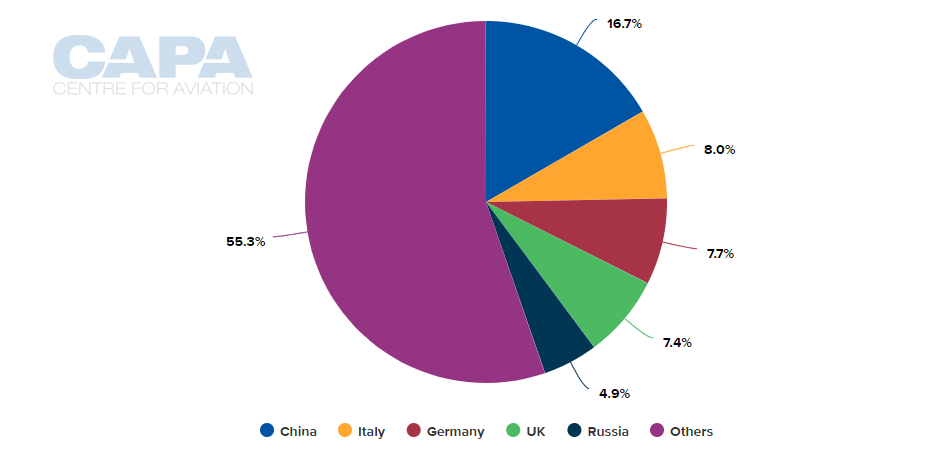

VISITOR ARRIVALS BY MARKET (2019)

MONTHLY VISITOR ARRIVALS AND SEASONALITY IN DEMAND (2017 - 2020)

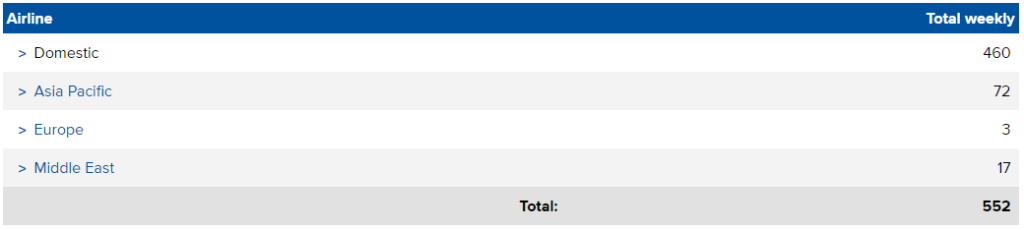

SCHEDULE MOVEMENT SUMMARY (w/c 12-Oct-2020)

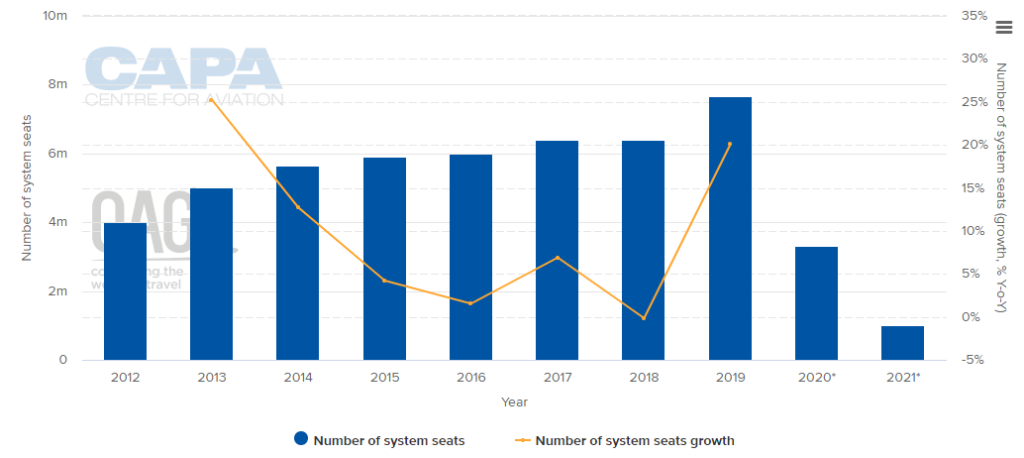

ANNUAL CAPACITY (2012 - 2021*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

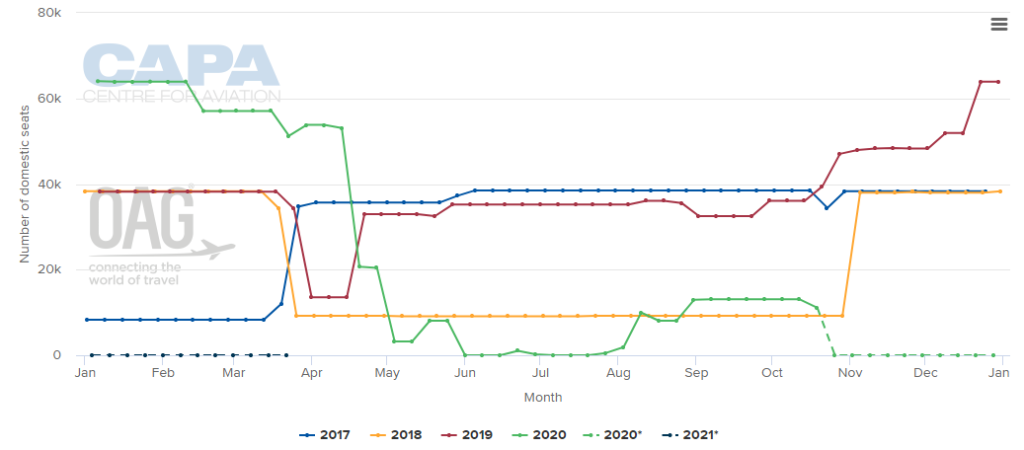

WEEKLY DOMESTIC CAPACITY (2017 - 2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

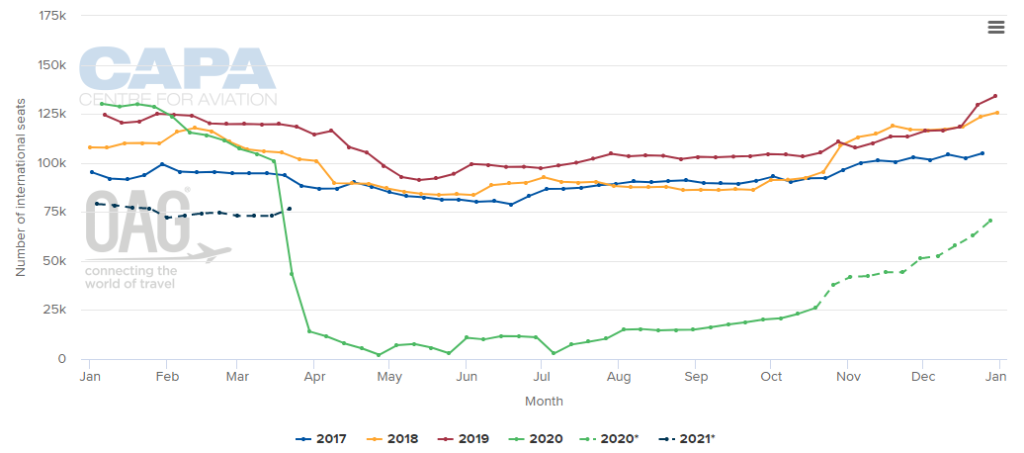

WEEKLY INTERNATIONAL CAPACITY (2017-2020*)NOTE:*the values for this year are at least partly predictive up to six months and may be subject to change.

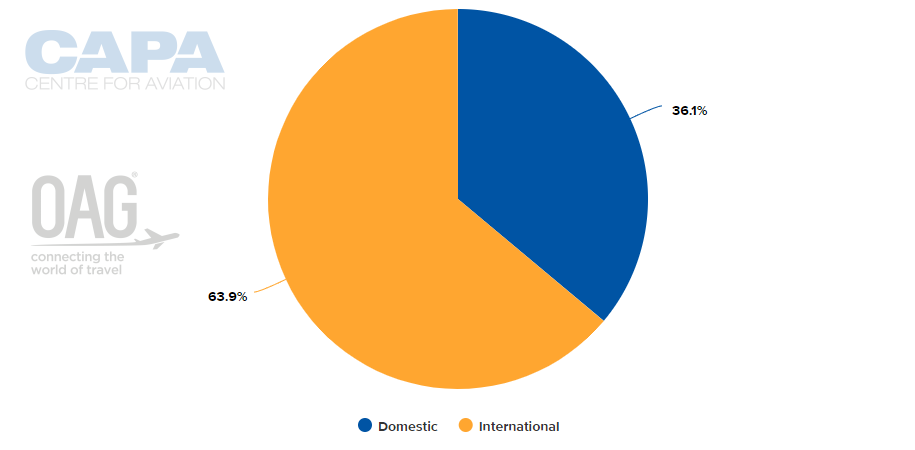

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 12-Oct-2020)

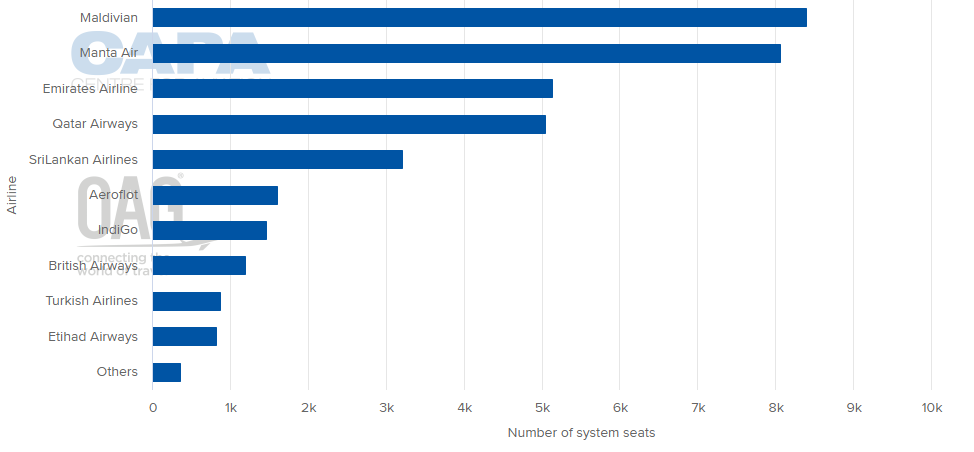

LARGEST AIRLINES BY CAPACITY (w/c 12-Oct-2020)

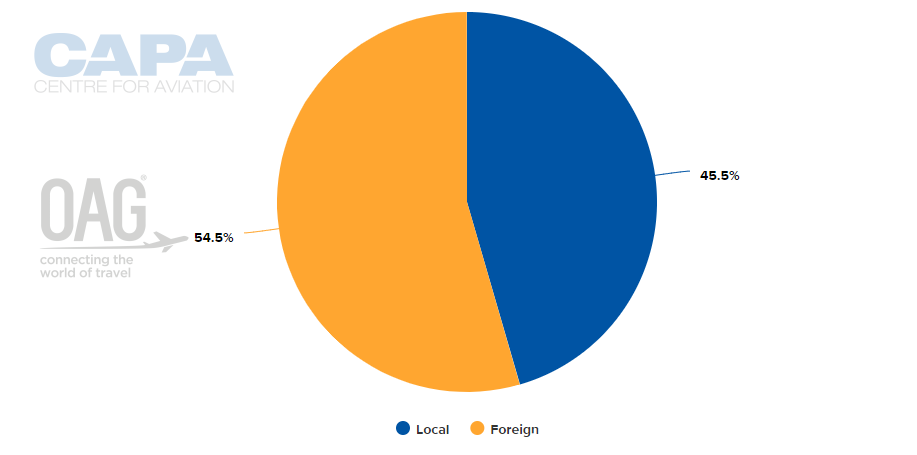

CAPACITY SPLIT BETWEEN LOCAL AND FOREIGN OPERATORS (w/c 12-Oct-2020)

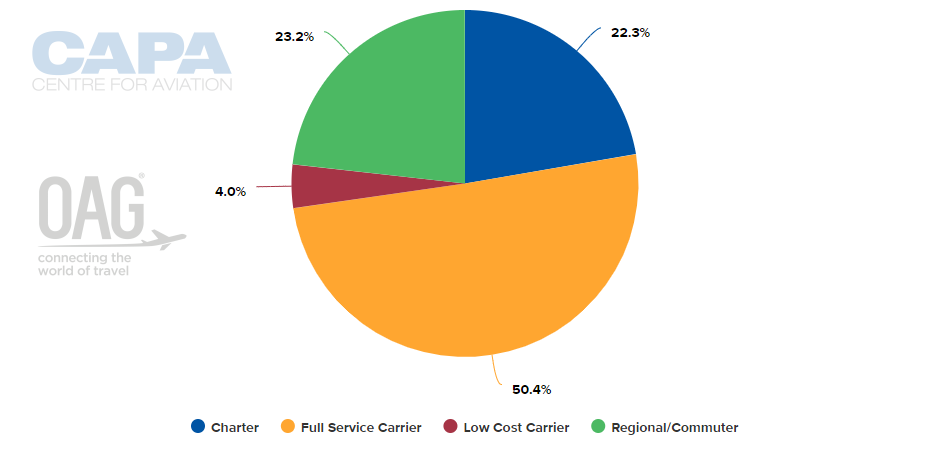

AIRLINE BUSINESS MODEL CAPACITY SPLIT (w/c 12-Oct-2020)

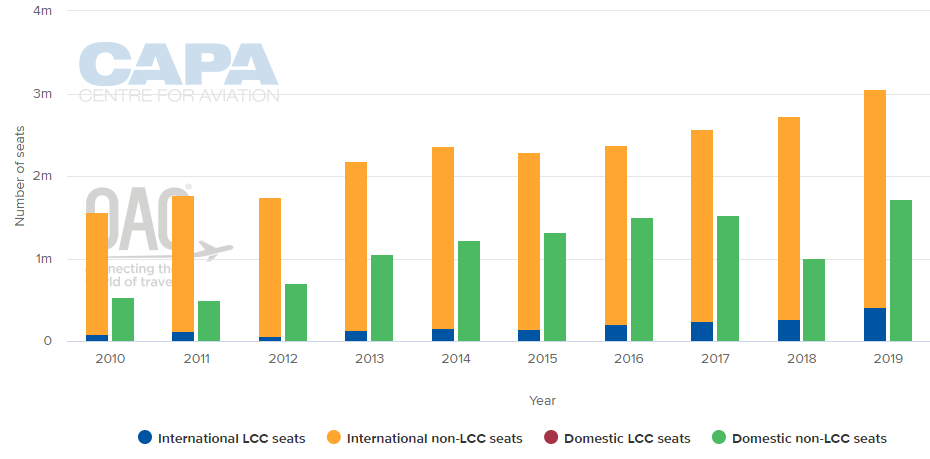

DEVELOPMENT OF LCC ACTIVITY IN COUNTRY (2009 - 2019)

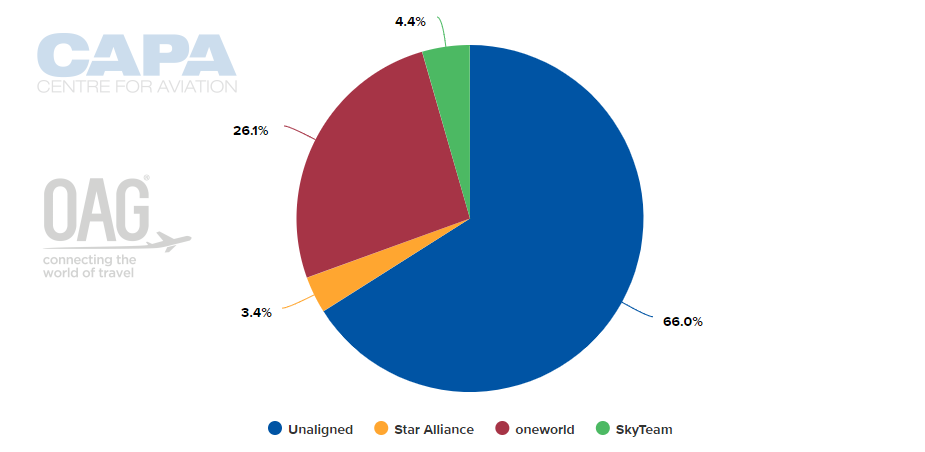

ALLIANCE CAPACITY SPLIT (w/c 12-Oct-2020)

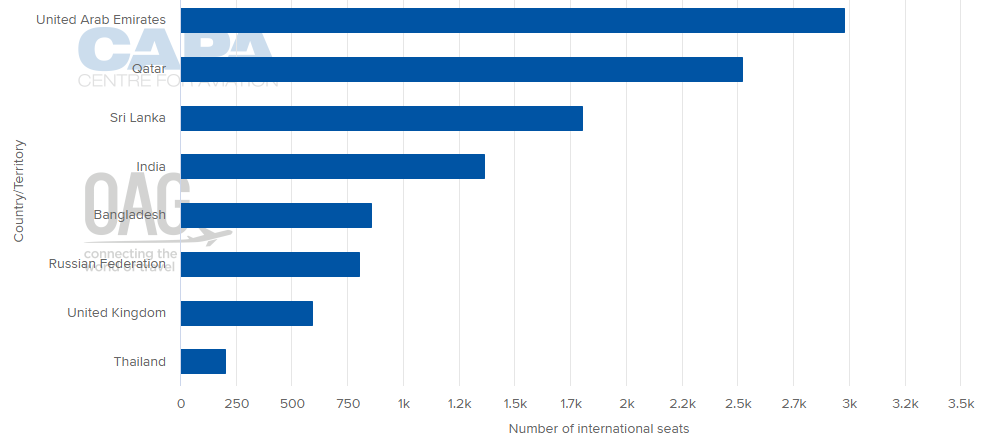

INTERNATIONAL CAPACITY BREAKDOWN BY COUNTRY (w/c 12-Oct-2020)

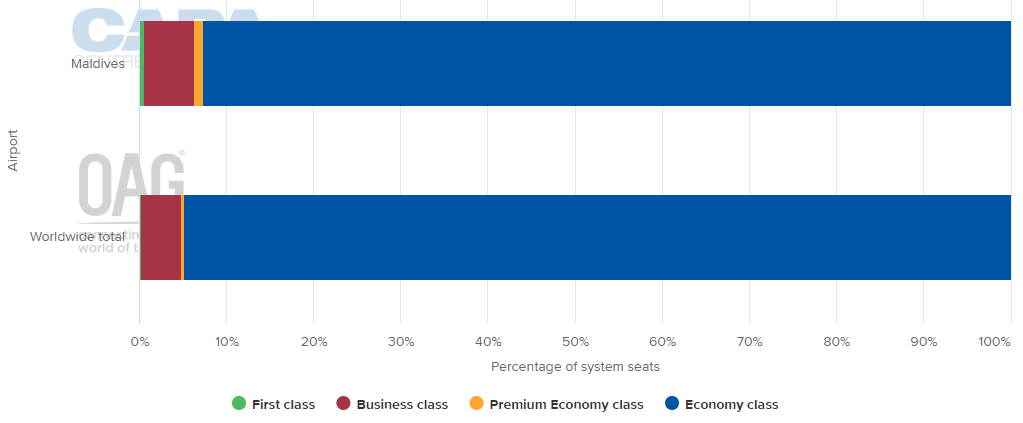

DEPARTING SYSTEM SEATS BY CLASS (w/c 12-Oct-2020)

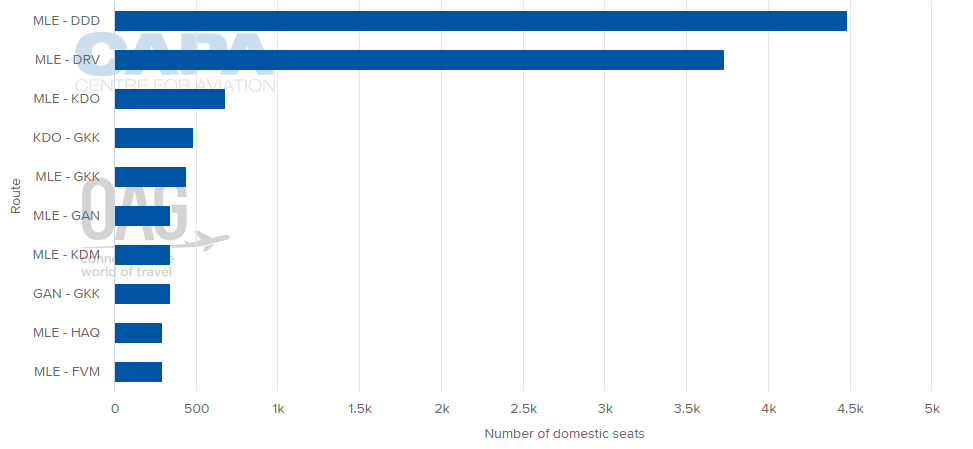

BUSIEST DOMESTIC MARKETS BY CAPACITY (w/c 12-Oct-2020)

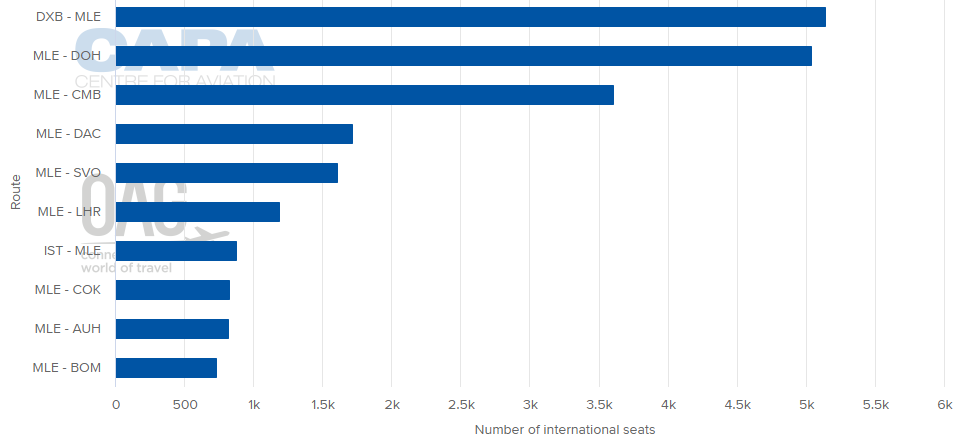

BUSIEST INTERNATIONAL MARKETS BY CAPACITY (w/c 12-Oct-2020)

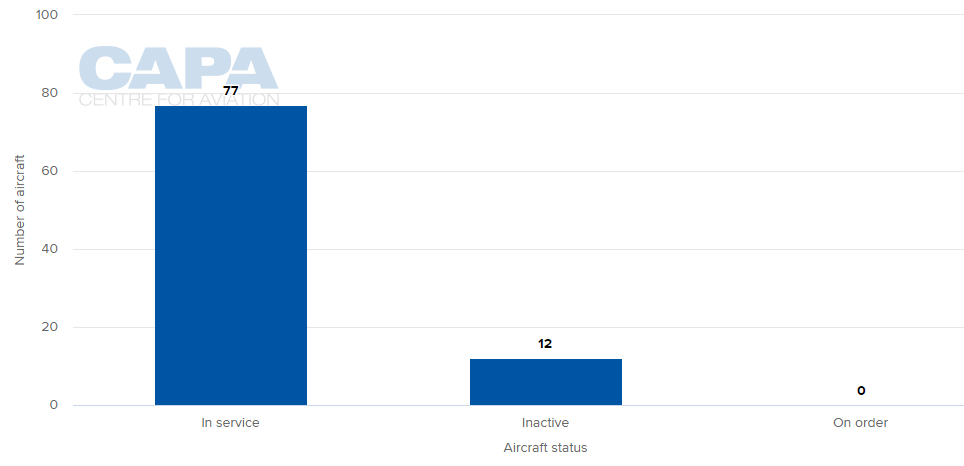

LOCAL AIRLINES' AIRCRAFT FLEET (as at 12-Oct-2020)

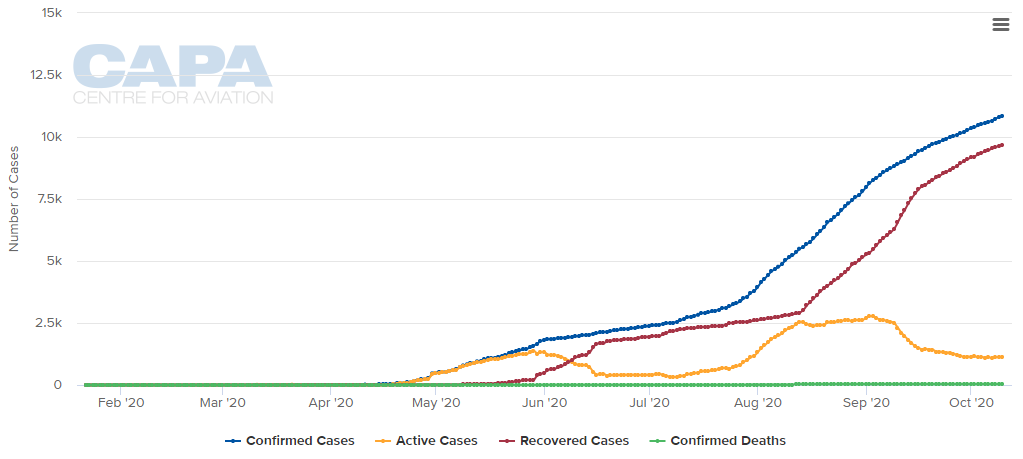

COVID-19 INFECTIONS (as at 12-Oct-2020)

MORE INSIGHTS:

Corporate travel. A glass quarter-full is still plenty

Corporate and business travel will undergo a fundamental transformation