The enormous size of Russia means that a domestic flight can be defined as a long-haul operation. At a time that international travel remains significantly limited by travel restrictions, the scale of the domestic market has meant many of the country's airlines have manged to maintain some form of operation during the Covid-19 pandemic.

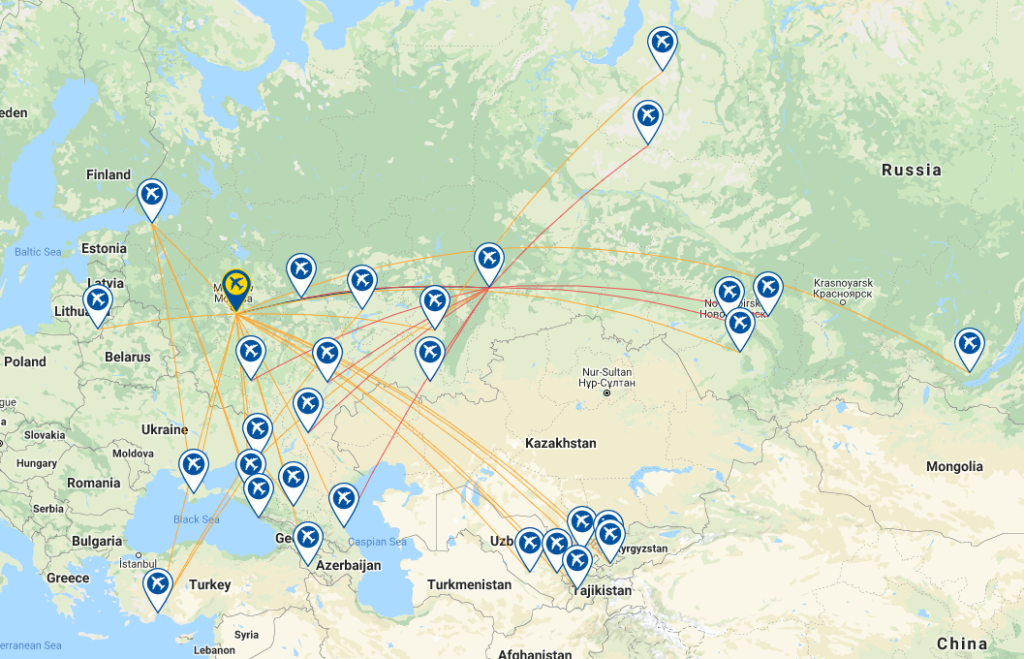

For the Ilyushin Finance-owned Red Wings the plan is to be build a pan-Russian network of flights through the establishment of regional hubs throughout the country serving both local traffic and providing international connectivity. The first steps are already operational in Moscow and more recently Yekaterinburg, but will likely also spread to other major cities such as Irkutsk, Mineralnye Vody, Sochi, St Petersburg and into the Baltic exclave of Kaliningrad.

ABOUT

Red Wings is a Russian carrier based at Moscow Domodedovo Airport. Founded in 1999 as Airlines 400, the carrier operates scheduled and charter services utilising narrow body Tupolev equipment. Russia's Federal Air Transport Agency (Rosaviatsiya) suspended Red Wings' Air Operator's Certificate (AOC) on 04-Feb-2013. The carrier since relaunched services on 18-Nov-2013 and switched its operating base from Moscow Vnukovo to Moscow Domodedovo following investment from Ilyushin Finance Company. Nordavia and Red Wings commenced work on consolidation to establish an aviation holding with a single managing company. The aim of the consolidation is to enlarge the business and gain the opportunity to improve financial stability, renew the fleet, develop a single network and increase effectiveness.

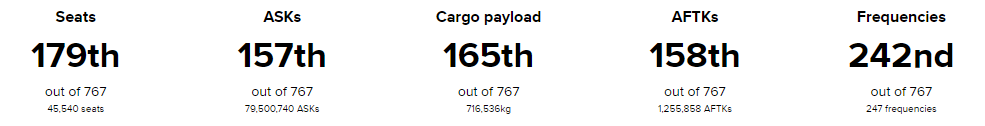

GLOBAL RANKING (as at 12-Oct-2020)

NETWORK MAP (as at 12-Oct-2020)

DESTINATIONS (as at 12-Oct-2020)

CAPACITY SNAPSHOT (versus same week last year)

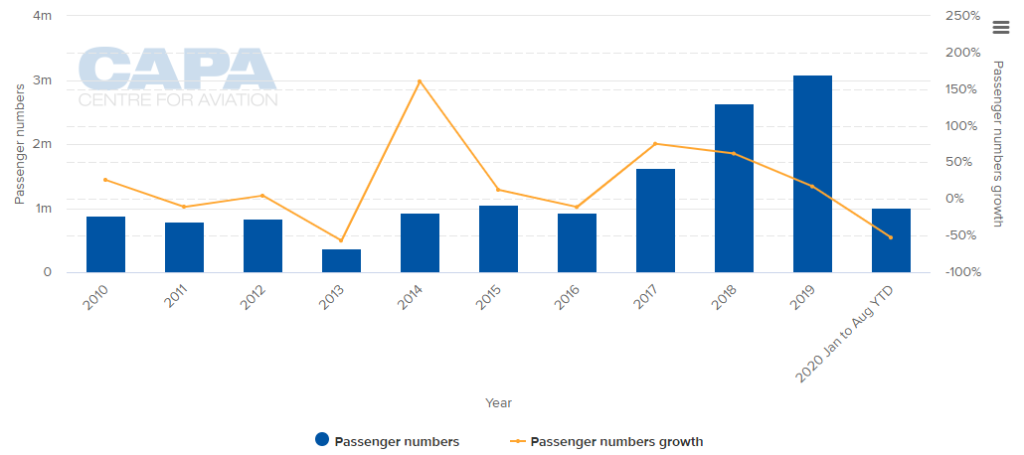

ANNUAL PASSENGER TRAFFIC (2010-2020YTD)

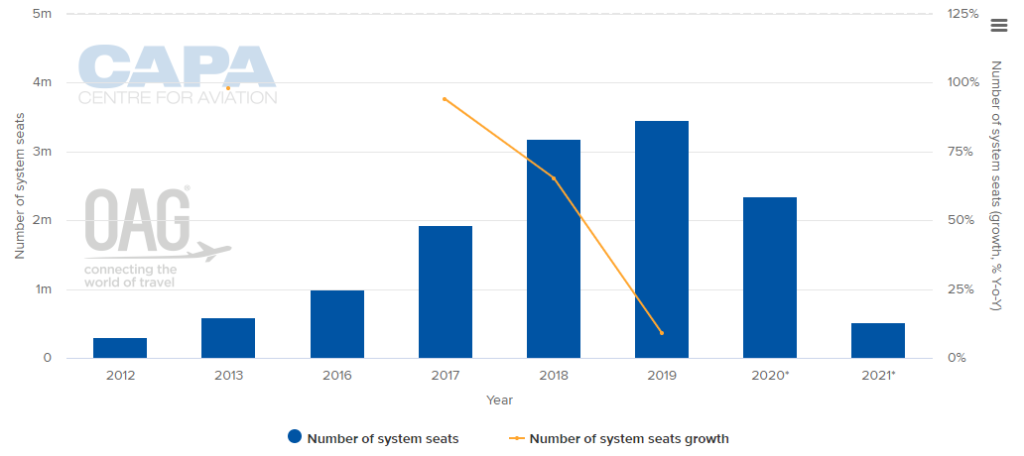

ANNUAL CAPACITY (2012-2020*)(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

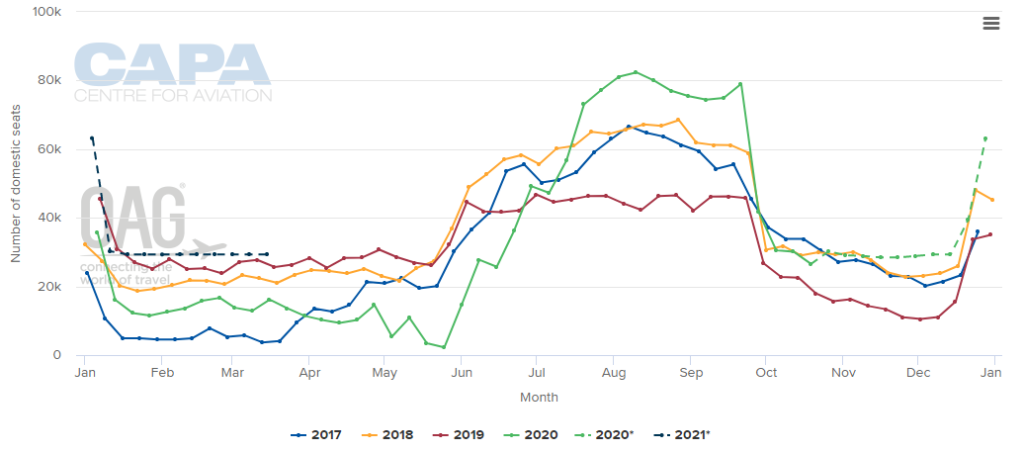

WEEKLY DOMESTIC CAPACITY (2017 - 2020*)(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

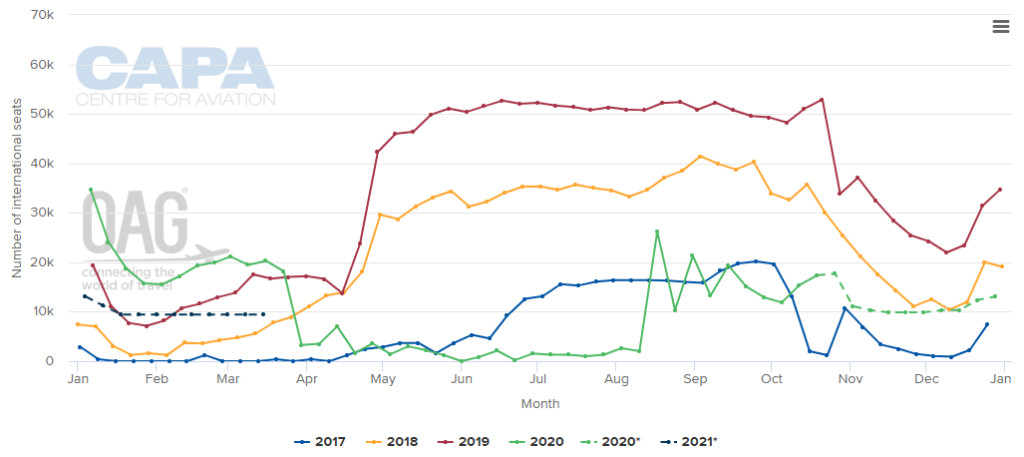

WEEKLY INTERNATIONAL CAPACITY (2017 - 2020*)(NOTE:The values for this year are at least partly predictive up to 6 months and may be subject to change)

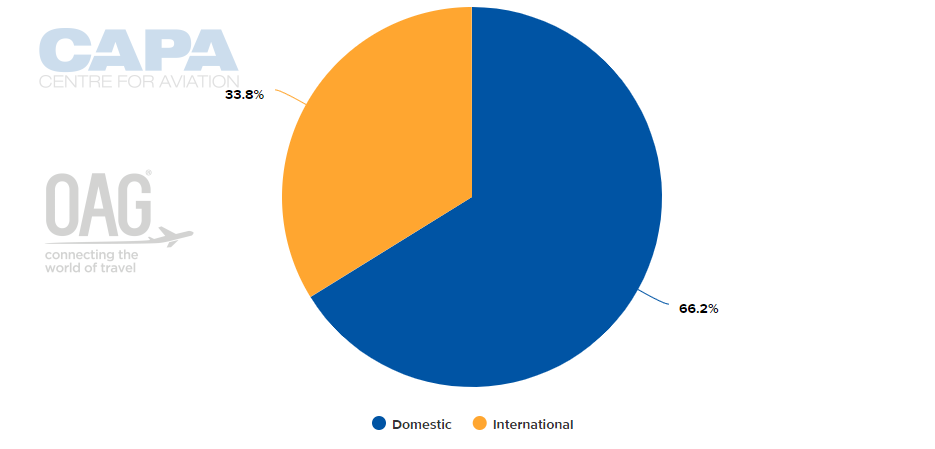

CAPACITY SPLIT BETWEEN DOMESTIC AND INTERNATIONAL OPERATIONS (w/c 12-Oct-2020)

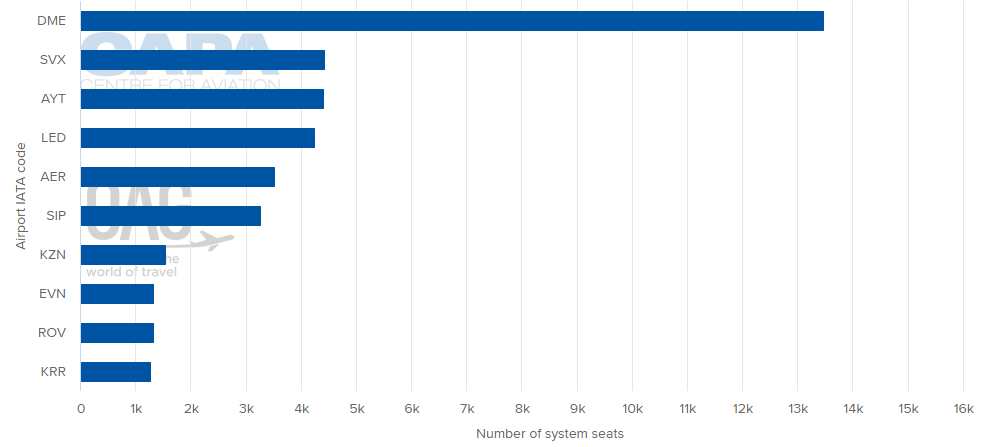

LARGEST NETWORK POINT (w/c 12-Oct-2020)

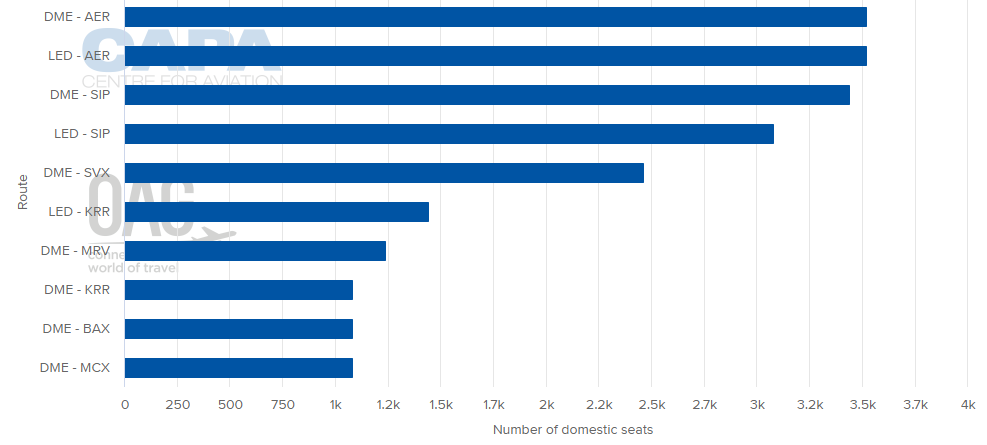

BUSIEST DOMESTIC ROUTES BY CAPACITY (w/c 12-Oct-2020)

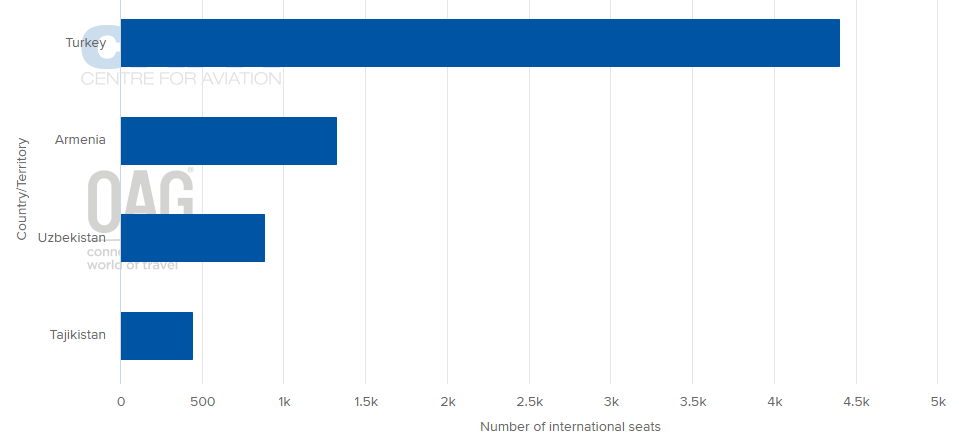

LARGEST INTERNATIONAL MARKETS BY COUNTRY (w/c 12-Oct-2020)

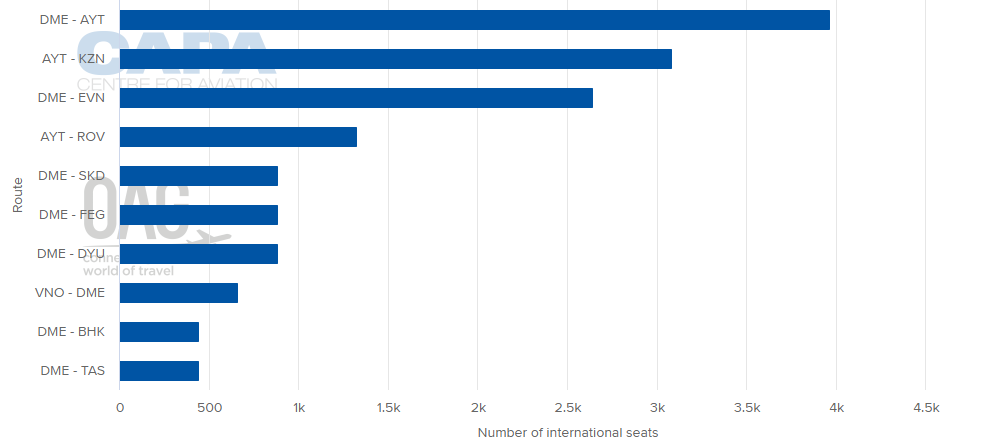

BUSIEST INTERNATIONAL ROUTES BY CAPACITY (w/c 12-Oct-2020)

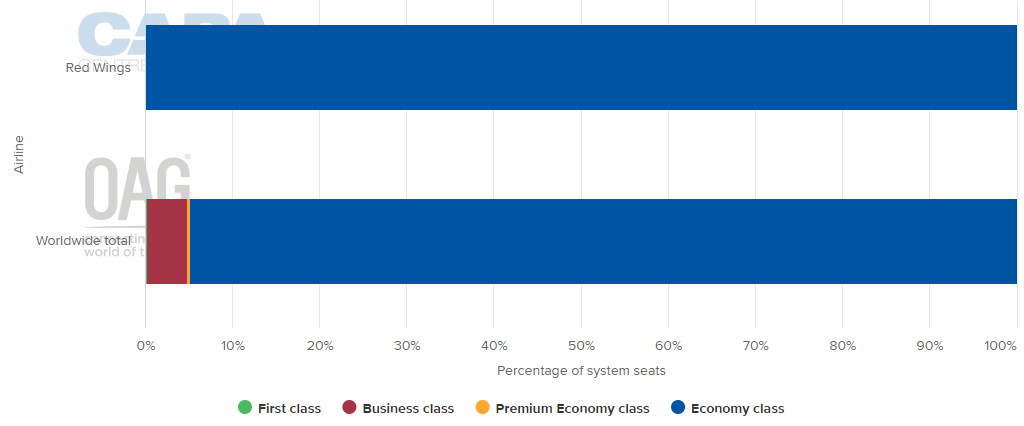

DEPARTING SYSTEM SEATS BY CLASS (w/c 12-Oct-2020)

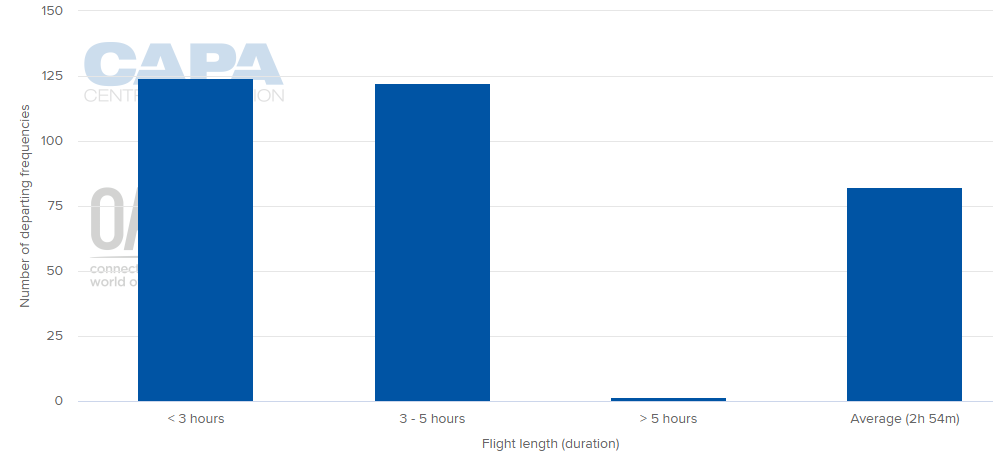

AVERAGE FLIGHT LENGTH (w/c 12-Oct-2020)

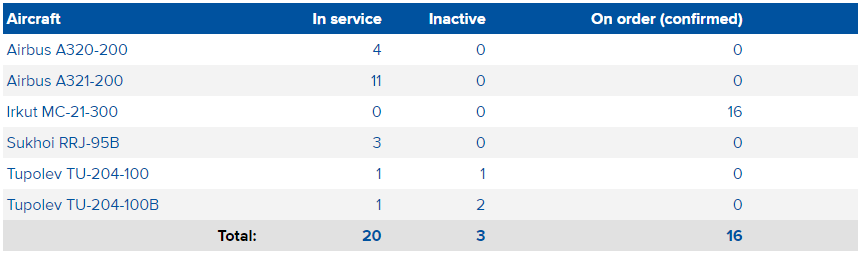

FLEET SUMMARY (as at 12-Oct-2020)

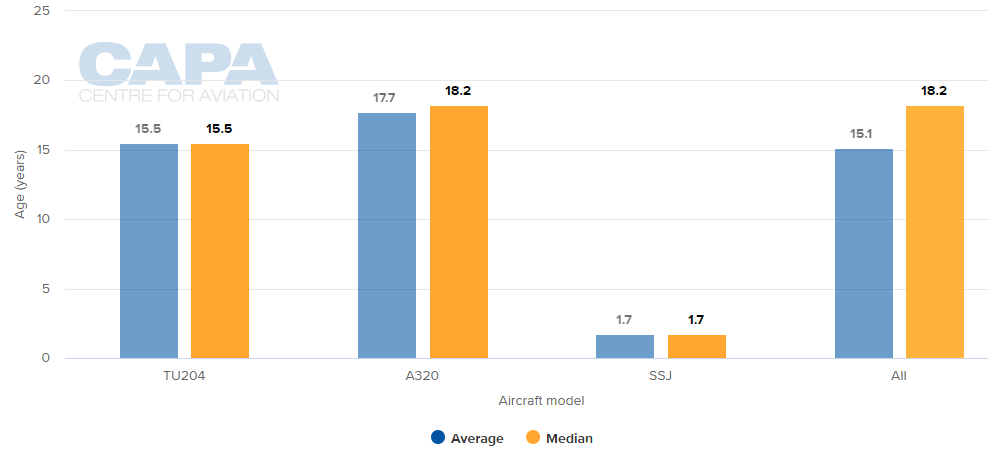

AVERAGE FLEET AGE FOR IN-SERVICE AIRCRAFT (as at 12-Oct-2020)

MORE INSIGHT...

Aeroflot chief calls for 'LCC airports' in Russia - are they needed?

Russia now Europe's #1 airline market, thanks to domestic size