However, nine years on and European budget carrier Norwegian has firmly put the facility on the map and officials are now expected to put the New York name into its title to "easily and quickly associate airport with the New York region" and establish it as a "convenient, low cost options for the New York and New Jersey region".

Back in 1999, the lessee was a US subsidiary of the British bus and rail operator National Express, which at that time also managed East Midlands and Bournemouth airports in the UK (it has since exited the airport sector altogether). But less than a decade later Stewart had already reverted back to public control and in 2007 the Port Authority of New York and New Jersey (PANYNJ) took over the remaining 93 years of the lease, promising to invest USD500 million in the airport in a 10-year capital improvement plan (it actually managed USD200 million).

National Express had had positive intentions but it was more concerned with its yellow school bus operations in the state and while peripheral airports around London that were nearer to the capital grew quickly at the time that was not the case in New York. Stewart had become a bad investment and the company threw in the towel.

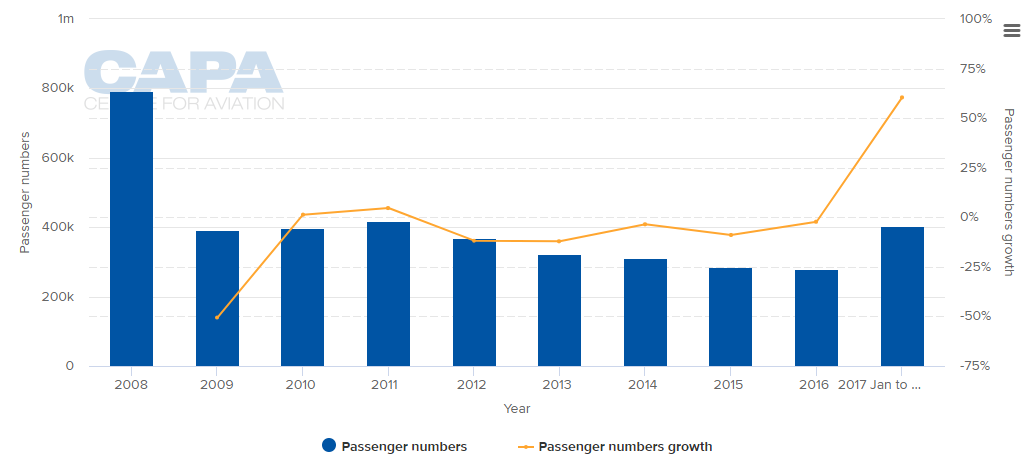

Stewart struggled on for years, supported mainly by regional subsidiaries of American Airlines and Delta Air Lines and more recently the point-to-point activities of LCCs such as JetBlue and Allegiant Air. In the period 2009 to 2016 the 'growth' rate averaged -10.4% per annum. In 2009, two years after the PANYNJ took control, it was -50.6%.

CHART - The arrival of Norwegian has boosted traffic levels at Stewart International Airport, but levels are still down on those recorded in 2008 Source: CAPA - Centre for Aviation and Stewart International Airport

Source: CAPA - Centre for Aviation and Stewart International Airport

No great powers of observation are needed though to appreciate a sea-change in 2017 (to November, chart figures only available at the current time), where there was a growth rate of +60.4%, to almost 450,000 passengers; 141,000 of them international.

This is accounted for mainly by the arrival of European long-haul low-cost specialist Norwegian, which serves five intercontinental destinations: Bergen in Norway; Edinburgh and Belfast in the UK; and Dublin and Shannon in the Republic of Ireland. Norwegian also operates to two other secondary airports in the US northeast - Hartford and Providence - but Stewart, or New York Newburgh as it calls it, is where it has its largest network focus.

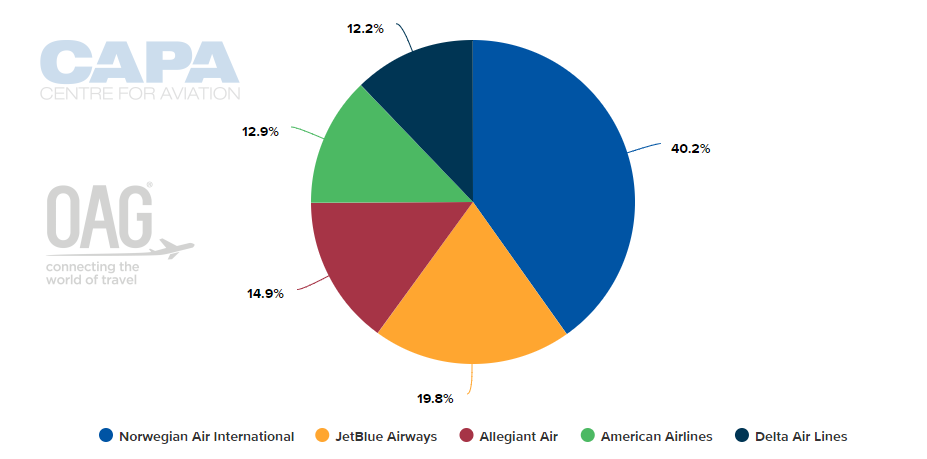

Norwegian's seat capacity share is currently 40% but it is not responsible for all the passenger growth as a limited degree of self-connection activity involving other airlines also takes place.

CHART - Norwegian is the largest operator at Stewart International but JetBlue also offers links to Fort Lauderdale and Orlando; American Airlines to Philadelphia; Delta Air Lines to Detroit and Allegiant Air to Orlando Sanford, Punta Gorda, St Petersburg/Clearwater and a seasonal Myrtle Beach link. Source: CAPA - Centre for Aviation and OAG (data: w/c 12-Feb-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 12-Feb-2018)

Despite the Port Authority's investment, Stewart has lacked some critical facilities, notably a permanent Customs and Border Protection facility. Now, that will be rectified by a USD30 million cash injection to construct a facility to screen up to 400 international passengers each hour. Currently, international passengers are handled by way of a moveable wall that sections off part of the terminal like something from a movie lot.

At the same time an RFP has been issued for a carport with a solar panel roof which will cover 450 vehicle spaces and create 1.9 megawatts of power that will be used to offset energy costs at the expanded terminal.

Stewart, which may also have its name changed now, has attracted support from politicians, including New York Governor Andrew Cuomo, who perceives that Stewart can help provide the opportunity for further growth and tourism in the Mid-Hudson Valley and New York metropolitan region. No mention of relieving capacity issues at the three main New York airports but that could come.

Stewart still has problems to contend with. It is not easily accessible from New York City or vice versa though various improvements to the rail network are planned. Then again, it is not wholly reliant on scheduled commercial passenger traffic. UPS and FedEx both operate there and there is a US Postal Service mail facility.

Moreover, with the goal of increasing private flight activity at Stewart by as much as 20% an agreement was concluded with Signature Flight Support to build a new hangar dedicated to private aircraft.

Given the positive news for private sector airport investors arising out of President Trump's Infrastructure Plan speech one has to ponder why no-one in that sector foresaw these developments in 2007 and offered to take over the lease from National Express.

But it would have been very difficult even to envisage Norwegian and its activities 11 years ago, at a time when long haul low-cost was struggling desperately for public acceptance. And of course no-one knows now what the future might bring as Norwegian wrestles with a "nightmare" 2017 P&L account (an operating loss of EUR214.6 million, compared to a profit of EUR195.7 million in the previous year) and unit costs worryingly on the rise in 4Q2017.