Summary:

- The Etihad Aviation Group recently embarked on a total restructure that will see Etihad Airways reanalyse its network and wider fleet development plans;

- The restructuring is indicative of the carrier opting to move away from evolving into a Middle Eastern 'mega connector' as per its previous business strategy;

- Etihad is now open to more commercial partnerships and has displayed its attentiveness in the need to generate ancillary revenue streams;

- While Etihad has offered an upgrade programme for some time, the addition of a live auction element - the first for the region - will bring more awareness.

"We don't believe that doubling the size is likely to be sustainable at this time, but we've got enduring long term relationships with the aircraft manufacturers and therefore that process is constantly under review", highlights newly appointed Etihad Airways CEO Tony Douglas.

The restructuring is also indicative of the carrier opting to move away from evolving into a Middle Eastern 'mega connector'. Instead of pursuing a pure hub and spoke operating model akin to Emirates, Etihad has now recognised the need for more sensible growth - and many once-customary qualities of the Gulf carrier could undergo transformation.

For example, Etihad is now open to more commercial partnerships. The carrier is no longer recognised as a competitor to Star Alliance, meaning airlines from the alliance are free to codeshare with Etihad. Mr Douglas explains: "In the past, the Etihad Group was identified as being an alliance itself and, consequently, under the rules of Star Alliance, its members were not allowed to engage in collaboration with us on codeshares". He asserts that Etihad will now "be able to go around the Star partners to build connectivity with their networks through codeshares wherever both parties agree to do so".

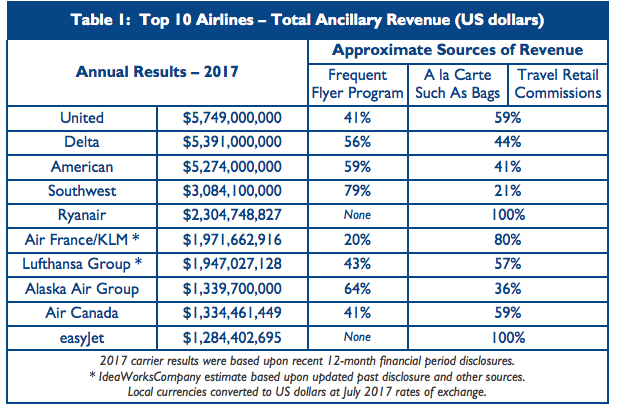

More recently, Etihad has displayed its attentiveness in the need to generate ancillary revenue. Ancillary revenue has become a mandatory component of the revenue mix for all airlines - regardless of a carrier being an LCC, FSC or hybrid. According to CarTrawler and IdeaWorksCompany, the 10 largest airlines by ancillary earnings generated USD29.7 billion in ancillary revenue in 2017, up from USD2.1 billion in 2008.

Source: CarTrawler and IdeaWorksCompany

Source: CarTrawler and IdeaWorksCompany

The new bidding system operates in real time, providing for more customer engagement and potentially more revenue

While Etihad has offered an upgrade programme for some time, the addition of a live auction element is hoped to stimulate more awareness around the product and drive more bids.

Customers will be able to take part in a bidding system where real time notifications of their bid will be displayed on their screen, allowing two or more individual bids at the same time. Regular email and SMS updates will also be sent to notify them if they have been outbid.

From the above CarTrawler/IdeaWorksCompany study, it can be extrapolated that no Middle Eastern carriers generated comparable ancillary revenue to their American and European counterparts. The likes of Emirates, Etihad and Qatar have traditionally been able to rest on strong passenger revenue derived from bundled fares.

The new live auction system is actually a first for the region, while the added gamification layer will see passengers directly competing with each other for the upgrade. This differs to upgrade systems in place at other airlines - say Virgin Australia, which Etihad holds a stake in - which sees bids internally reviewed by an automated system and accepted if made over a previously-set price point.