Across all industries a respected and well recognised brand is not enough to guarantee survival. Aviation is no different and over the last two decades in Europe alone we have already lost famous flag carriers such as Olympic Airways in Greece, Swissair in Switzerland, Sabena in Belgium, Malev in Hungary and more recently airberlin in Germany.

For a long time now Alitalia has stood close to the precipice. The airline has been in a downward tailspin for many years as legacy costs and union contracts have made it difficult for the airline to change its business model to adapt to the changing dynamics of the European air transport market. To be honest the unprofitable airline has been haemorrhaging cash and has been on life-support for many years. Only the recent support of Etihad Airways and the Italian government have pumped the sufficient funds to keep the ailing business alive.

As time continues to tick down ahead of the national elections on 04-Mar-2018, it becomes less and less likely the Italian Government will enter exclusive negotiations with an investor to acquire Alitalia. Italy's national carrier has been a specimen of uncertainty for years, only reporting profitable operations in small spurts during its 70-year history. The carrier is still operating despite being in the midst of insolvency, thanks to one of many Government bridge loans, yet three firms remain interested in acquiring the ailing carrier: US capital fund Cerberus, easyJet, Lufthansa Group.

Divestment of Alitalia has been complicated immensely by the Government's insistence to sell the carrier as a whole, rather than a sale in packages. The Italian Government also seeks to protect Alitalia's workers through industrial pledges, which seek to retain the full force of Alitalia's 11-12,000 staff. Compare this, for example, to TAP Air Portugal - which operates a similar number of aircraft as Alitalia but with a workforce of 7300.

The big question is why hasn't the Government been able to enter exclusive negotiations with an investor? It appears that each potential investor for Alitalia either does not meet the Government's requirements to acquire the carrier as a whole, or cannot reach a middle ground with the Government on some aspect.

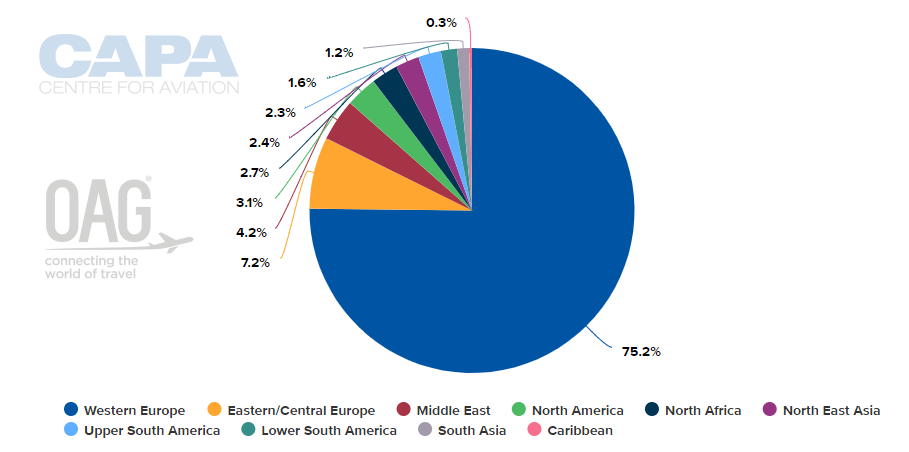

CHART - Alitalia's network is heavily weighted to western Europe with more than three quarters of its group capacity in this market Source: CAPA - Centre for Aviation and OAG (data: w/c 19-Feb-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 19-Feb-2018)

Here's a closer look at the bidders:

Cerberus and easyJet: Initially thought to have a collective interest in Alitalia, Cerberus would have backed easyJet in the acquisition of Alitalia's short haul aircraft and landing rights. Italian media then reported easyJet as opting to continue to pursue Alitalia without Cerberus, however the capital fund still retained interest. easyJet's infatuation with Alitalia can be extrapolated from the Italian national carrier's leniency towards short/medium haul routes, with 50% of its mainline seats operating to Western Europe. Cerberus is cited as the most interested in a full acquisition of Alitalia, however it is unknown how the company would own a majority share of the company under EU ownership rules.

Lufthansa Group: Lufthansa's chairman and CEO Carsten Spohr has issued a series of calls on Alitalia's commissioners to implement "key restructuring measures", which Mr Spohr believes would be "beneficial to all prospective bidders". Unions have suggested the measures are a precondition for Lufthansa to enter Alitalia's ownership. In response, Italy's Minister of Infrastructure said the German group can "do much better" in its bid submitted to acquire Alitalia. Italian media suggests the Government seeks EUR500 million for the carrier, while Lufthansa's offer was reported at around EUR300 million.

Many other airlines had previously been linked with possible bids, including Ryanair, Hainan Airlines, Air France (in a consortium with easyJet) and Wizz Air.

It is clear that the bidders remain unprepared to commit until Italy's elections are concluded, but could this ultimately mean more uncertainty for Alitalia.

Italian political party Lega Nord (North league), which will form part of the wider coalition currently slated to win the Italian parliamentary election, has recently weighed in on its stance towards Alitalia's insolvency. Party leader Matteo Salvini is of the perspective Italy "needs a flag carrier", and Alitalia's insolvency should not mean "fire sales to multinationals or foreigners". Another potential spanner in the ownership of Alitalia is the recent nationalist push, with Lega Nord stating it is not opposed to an exit from the EU.

But amid this turbulence there are some bright lights as Alitalia shows somne positive signs. Despite a tough political climate, Alitalia's operations are actually said to be improving. Alitalia CCO Fabio Lazzerini has said he expects the carrier to report a "considerable" increase in both sales and passengers in 2018, while insolvency commissioner Luigi Gubitosi forecasts the airline to report a year-on-year revenue increase of 4% to 5% in 1Q2018.

The airline continues to restructure its business model, leaning towards a more hybrid approach, and has also consolidated a range of its routes to focus more on main European business cities.

So, how do you solve a problem like Alitalia? Nobody has been able to develop a sustainable answer to date, but the only guarantee is time will ultimately deliver a solution - whether that is positive or negative!