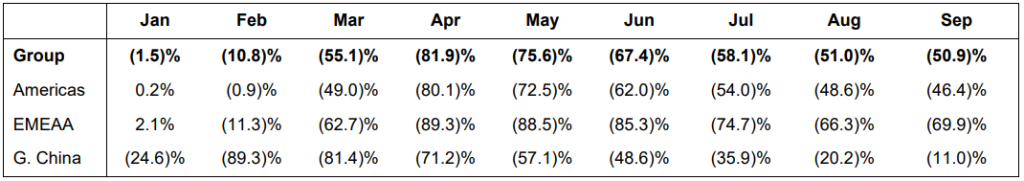

Its results for the three months shows that trading has improved, but RevPAR was still down -53% year-on-year and shows the long journey still ahead. Still, this represented a significant improvement on the performance in 2Q 2020 when levels fell to -75%. Occupancy follows a similar trend increasing from 35% in 2Q 2020 to 44% in 3Q 2020.

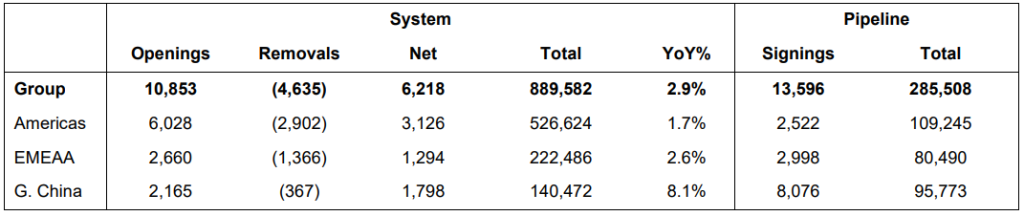

But around 200 hotels - approximately 3% of its property estate - still remained closed as at 30-Sep-2020. Despite this, IHG grew its system by +2.9% year-on-year with a global estate now numbering 890,000 rooms across 5,977 hotels. In 3Q 2020 it added 11,000 rooms across 82 hotels, bringing its year-to-date total to 23,000 rooms.

Keith Barr, CEO of IHG, says there is a "recognition of consumer preference" for IHG's brands that has enabled it to sign a further 14,000 rooms across 82 hotels to its pipeline. This brings the year-to-date total to 40,000 rooms across 263 properties, more than a quarter of which are conversions. Its total pipeline as at the end of Sep-2020 stood at 286,000 rooms across 1,899 hotels.

"A full industry recovery will take time and uncertainty remains regarding the potential for further improvement in the short term, but we take confidence from the steps taken to protect and support our owners and drive demand back to our hotels as guests feel safe to travel," says Mr Barr.

Domestic mainstream travel remains the "most resilient," and he believes IHG's Holiday Inn brand family in particular will position the group well to meet that demand as it slowly returns. But regional variance in demand remains an ongoing challenge, especially while COVID-19 spikes continue across many parts of the world.

In 3Q 2020 it was the Americas that highlighted the varying domestic and international demand most clearly. Across the whole region IHG reported RevPAR down -49.8% and occupancy of 46% (up from 28% in 2Q 2020). US RevPAR was down -47.3%, with its US franchised estate, which benefits from a weighting towards domestic demand-driven mainstream hotels, declining by -43%, while the US managed estate declining -71% due to its weighting to luxury and upscale hotels in urban locations, popular with international and business travellers.

Across Australia, Europe and the Middle East, 3Q 2020 RevPAR declines were more pronounced - Europe hit the lowest levels, down -72%, Australia was down -66%, while the Middle East declined -65%. Across the full Europe, Middle East, Asia and Africa regions RevPAR was down -70.4% and occupancy was 31%. As government-mandated closures and travel restrictions partially eased, leisure-related demand led to the rate of RevPAR decline improving in Jul-2020 and Aug-2020, before weakening in Sep-2020, IHG acknowledges.

It is a very different story in Greater China where despite heavy restrictions on international travel, a strong domestic economy has helped reignite local demand. RevPAR was down 'just' -23.0% in 3Q 2020, while occupancy levels rose to 57%, having been 32% in 2Q 2020 and less than 10% in Feb-2020. In IHG notes that in Mainland China, RevPAR was down -32% in Tier 1 cities, whilst Tier 2-4 cities, which are more weighted to domestic and leisure demand, performed better with a decline of -12%.

Over the quarter IHG opened 2,200 new rooms in 10 hotels across Greater China, a net rooms growth of +8.1% year-on-year. Signings over the three month period totalled a further 8,100 rooms across 37 hotels, representing an increase in development activity on the same quarter last year. Additions to the pipeline included 24 franchise signings across its Holiday Inn Express, Holiday Inn and Crowne Plaza brands, and 13 signings of management contracts including those across other brands.