Summary:

- India will likely overtake Japan in scale in 2019 and become Asia's second largest aviation economy by departure capacity, says The Blue Swan Daily research;

- With a +13.5% growth in seats annual departure capacity from India will grow to over 205 million seats this year, just over a million seats less than Japan;

- India is one of 15 countries across Asia to more than double departure capacity since the start of the decade: Vietnam and Myanmar among standout performers.

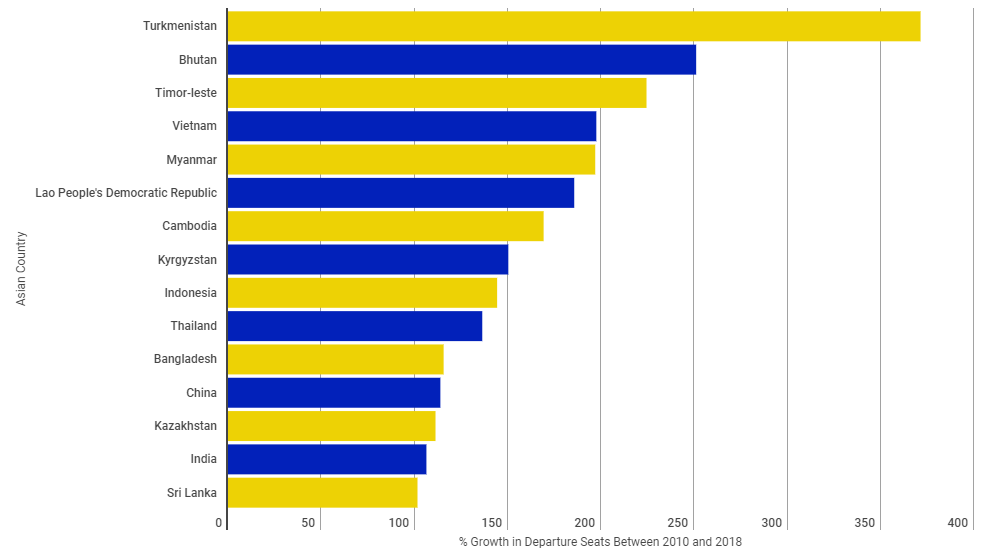

The growth of air transportation in India has been well documented and has seen departure capacity more than double since the start of the decade. But, it is just one of 15 countries to achieve this growth level and a compound annual growth rate (CAGR) of more than +9.1% across the period.

The Blue Swan Daily analysis shows that while two of the region's smaller nations - Bhutan and Timor - have actually trebled their departure capacity since 2010 (from very small bases), it is Vietnam and Myanmar that stand out as the fastest growing aviation economies. Myanmar actually also trebled its departure capacity between 2010 and 2017, but a -9.1% reduction in departure seats this year has seen that growth trend slip to +196.9%. Vietnam, will likely see its market triple in scale this decade with a 2010 to 2018 growth of +197.5%.

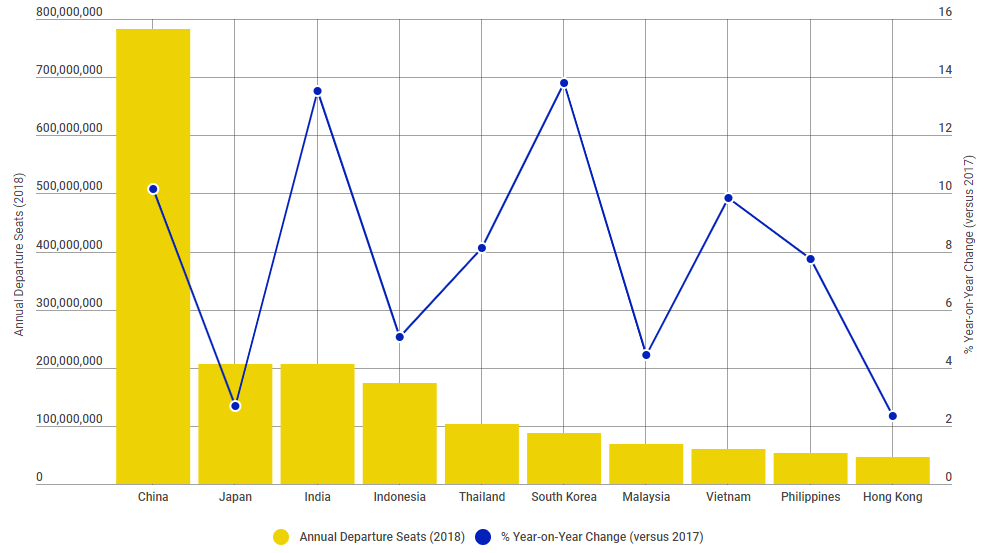

China continues to dominate in the region and its departure seat count for 2018 is actually larger than the second, third, fourth, fifth and sixth placed nations together. It has more than doubled in size since 2010 to over 782 million departure seats for 2018 and is set to exceed 850 million annual departure seats if it continues growing at similar rates.

CHART - China continues to dominate in the region and its departure seat count for 2018 is actually larger than the second, third, fourth, fifth and sixth placed nations together Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

The fourth and fifth ranked Indonesia and Thailand are also growing at high annual rates and seen a doubling in departure capacity already this decade. Indonesia saw its highest growth in the first three years of the decade, but levels has subsequently fallen with the +5.1% rate in 2018 the lowest this decade. Meanwhile, Thailand recorded its highest annual growth in 2013 (+16.1%) and 2015 (+20.5%), but again has seen levels slip into single digits over the past couple of years.

Hong Kong has seen steady growth this decade, but has the slowest growth rate (+41.3%) among the ten largest Asian markets; this has seen it slip down from being the eighth largest in 2010 to tenth in 2018 and in danger of being pushed out of the top ten by Taipei and Singapore in the coming years.

CHART - Turkmenistan has seen the largest rise in departure capacity this decade, one of 15 nations to more than double departing seats between 2010 and 2018 Source: The Blue Swan Daily and OAG

Source: The Blue Swan Daily and OAG

Outside of the top ten, alongside Myanmar, Bangladesh, Kazakhstan, Cambodia, Sri Lanka, Laos and Kyrgyzstan have all more than doubled departure capacity since the start of the decade.

The Central Asian country of Turkmenistan is actually the fastest growing nation across Asia this decade with growth in departure seats of +371.3% this decade following a major surge in capacity in 2015.

Meanwhile, Afghanistan is the only country in Asia to see capacity decline with departure seat level slipping from over two million in 2010, 2011 and 2012 to 1.97 million in 2017 and down to 1.82 million this year.