World aviation: back to the last century

It is no longer news to report that the COVID-19 pandemic has had a massive and devastating impact on the world aviation industry. Nevertheless, looking at various measures of the industry's scale in 2020 provides historical context. It illustrates how far this growth industry has been set back.

According to data from the CAPA Fleet Database, the number of passenger jet aircraft in service with the world's airlines at the end of 2020 was back to 2008 levels.

However, this 12-year setback is much less than the impact on traffic. Last year, in 2020, passenger numbers were back to 2003 levels, while RPKs were back to 1999's volume. Passenger load factor slumped to levels not seen since the 1980s and early 1990s.

Air cargo traffic was less badly affected, losing only five years of growth.

Early 2021 is not yet witnessing any improvement, but aviation's historic track record of growth was built on its role in economic growth and in connecting the world and its people. As vaccination programmes are rolled out, these factors give cause for optimism that aviation can return to growth.

TO READ ON, VISIT: World aviation: back to the last century

Hong Kong's airlines dealt another shock by new restrictions

While all airlines around the globe are struggling to survive the COVID-19 crisis, those in Hong Kong are particularly hard-hit. The pandemic and its resulting border closures represent a perfect storm for airlines with no domestic market and heavy reliance on international connecting travel.

The dominant airline, Cathay Pacific, has been struggling to gain demand momentum, and now the slight progress it has made is being threatened by strict crew quarantine rules that reduce operational flexibility and have forced the airline to suspend more routes.

The local industry has undergone consolidation in recent years, with Cathay taking over the local LCC Hong Kong Express and subsequently shutting down its Dragon subsidiary. Its only real locally based rival, Hong Kong Airlines, was already in rebuilding mode before the pandemic struck. Now HKA's future is under another cloud due to the bankruptcy restructuring of its major owner, HNA Group.

The weakened state of Hong Kong's airline industry also presents opportunity, however. Newcomer Greater Bay Airlines aims to launch services from Hong Kong, one of the few start-ups expected to emerge globally this year.

TO READ ON, VISIT: Hong Kong's airlines dealt another shock by new restrictions

European aviation pays the price for its international dependency

Europe's dependence on international markets was always going to be a threat in the recovery from the pandemic, and even more so, given differences in the level and timing of travel restrictions across the continent.

In 2019, the last pre-COVID year, more than three quarters of Europe's seats were international - much greater than in the other leading aviation regions (just over a third in Asia Pacific and a quarter in North America).

Yet restrictions on international travel in Europe have grown rapidly since Nov-2020, and are now second in their level of stringency only to Asia Pacific (where the recovery is now also stalling).

Europe's seat capacity in the week of 8-Feb-2021 is down by 75.4% versus 2019. It has been within a percentage point of this for four weeks now, but it is 1.0ppts worse than last week and much worse than any other region.

Middle East is down by 56.7%, Africa is down by 52.2%, Asia Pacific by 52.4% (the first time it has fallen by more than 50% since Jul-2020), North America by 46.4%, and Latin America by 43.8%.

TO READ ON, VISIT: European aviation pays the price for its international dependency

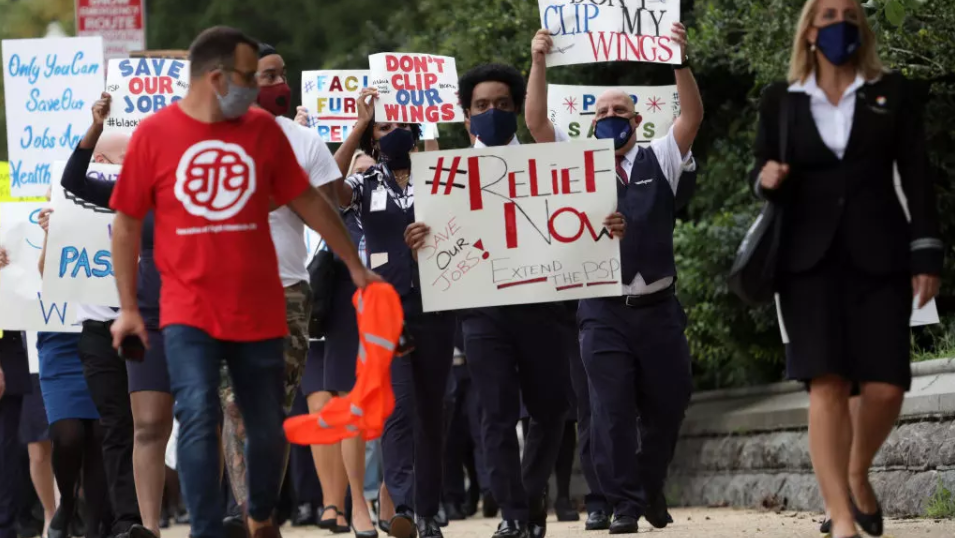

US aviation relief package gains momentum. Is it well targeted?

The change of administration in the U.S. means the new one getting to grips with the COVID-19 pandemic and handing out even more relief packages to many sectors of the economy that are still reeling from it.

The transport sector in general has not done too badly out of last year's (CARES) package, and this time around they can have up to USD50 billion in support out of USD1.9 trillion in total, with airlines, airports and manufacturers all qualifying.

But it seems that USD1 trillion of the previous package remains unspent, and the concern must be that if the government keeps on printing bailout money, the inflation that could follow would make it difficult to afford air travel in the 'post-COVID' future. It comes as COVID-19 vaccination statistics show a higher rate of take-up than was suspected.

TO READ ON, VISIT: US aviation relief package gains momentum. Is it well targeted?

CAPA Live: Ethiopian Airlines cash positive. 50 flights/week to China

African airlines were grounded for the period from Mar- to Sep-2020, and with no aid forthcoming it has been difficult for many airlines. As a result "the African airline industry has been severely damaged".

Ethiopian Airlines could see that there was an opportunity with cargo demand and made a quick decision to build up capacity. That has helped the airline manage its cash flow without any bailout money or borrowing, and without any lay-offs or any salary reduction.

The airline is operating to China with 50 widebody flights a week on average, plus operations to and via Europe with PPE and other medical supplies.

In the absence of meaningful partnerships Ethiopian has been trying to establish hubs in West Africa, Malawi and Chad, as well as with Zambia. They have also established an airline in Mozambique.

Talking at the CAPA Live on 10-Feb-2021, Ethiopian Airlines' Group CEO Tewolde GebreMariam spoke with CAPA's chairman emeritus Peter Harbison. Some of the verbatim highlights can be found below.

TO READ ON, VISIT: CAPA Live: Ethiopian Airlines cash positive. 50 flights/week to China

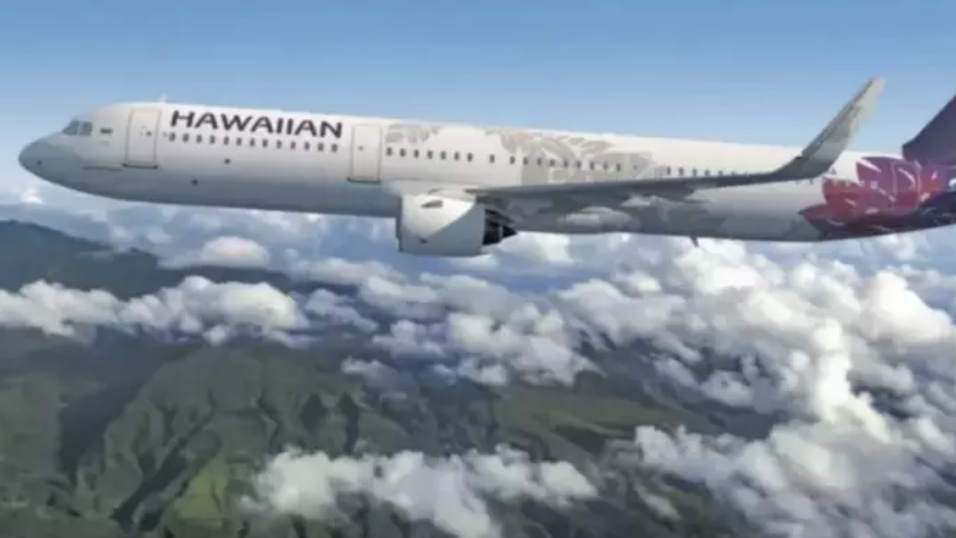

CAPA Live: Hawaiian Air successfully restructures its US government loan

Airlines worldwide have built up unprecedented levels of liquidity during the COVID-19 crisis, and it is not yet clear how those operators will approach balance sheet management over the long term.

But in the short term, some airlines are working to restructure the debt that they have taken on during the pandemic on more favourable terms - particularly government loans that were more restrictive than more traditional financing vehicles.

Hawaiian Airlines is one of those operators that are attempting to determine the more optimal liquidity levels over the longer term, but in the short term it has just tapped the markets for a transaction to pay off its loan from the US government, putting the airline in a more favourable position to manage its debt.

TO READ ON, VISIT: CAPA Live: Hawaiian Air successfully restructures its US government loan

London City Airport: few passengers; big (but sustainable) plans

All airports, whether they have an existing master plan in place or not, are having to think quickly on their feet as the pandemic unfolds.

One of them is the highly specialised London City Airport, which closed down entirely for a time in 2020. During that period it completed infrastructure projects which were already under way.

The airport also put into place a master plan based on a consulting exercise from 2019. It is one that results in very little additional infrastructure being built, well into the next decade, and an unerring focus on the sustainability of what there is already.

It could well become the new mantra for airports generally.

TO READ ON, VISIT: London City Airport: few passengers; big (but sustainable) plans

Airports and Saudi Arabia's new resort: can 'NEOM' challenge Dubai?

In early Feb-2021 arty television adverts began to appear in the UK and other countries extolling the virtues of what seemed at first glance to be a new tourist resort: NEOM ('New Future'), in the Middle East.

Those adverts were backed up by extensive advertising of Saudi Arabia on social media as a new and interesting tourist destination.

Desperate for new vacation opportunities (indeed - any such opportunities), those users who followed up the Internet link to 'whatistheline.com' found a much more comprehensive proposal - a megacity under construction in the northwest of Saudi Arabia, one that seeks to place the nation as a globally important country and diminish its reliance on oil. In fact, it will be run entirely on alternative energy.

In the first instance, two questions arise.

Firstly, can NEOM challenge Dubai as the principal regional centre? And secondly, just how easy or difficult will it be to travel and stay there, given the fact that Saudi Arabia has hitherto hardly been 'open for business' to the rest of the world?

TO READ ON, VISIT: Airports and Saudi Arabia's new resort: can 'NEOM' challenge Dubai?

Adani Airports: more expansion in India, more equity at Mumbai

The private sector has had a hard time of things where India's airports are concerned. The pace of privatisation was slow, and the administration of the very first round, in 2006, cumbersome and off-putting to some foreign investors, who never returned.

Others have complained about the poor level of representation in decision-making which was afforded to them by their minority shareholding, but what did they expect?

A more recent round has resulted in the emergence of the Adani Group, which is managing regional airports sufficiently well that Airports Authority of India is being financially rewarded from the concessions earlier than it might have expected.

Now Adani has secured a 74% stake holding in Mumbai's main airport, as well as in the new one, where there is some construction under way. This puts it in a more powerful position than most of its private sector predecessors.

The question is, how will it balance development at the old airport with that at the new?

TO READ ON, VISIT: Adani Airports: more expansion in India, more equity at Mumbai

Ukraine - Review of potential airport concessions

Numerous East European and West Asian countries would like to privatise their airports, preferably by concession, if they could. Often what is stopping them is irregular service by their own national flag carriers, very modest service by foreign full service airlines, and an absence of low cost services by any airline.

Ukraine is one of those countries, although it has been talking about a series of concessions since 2017 and the subject came up again in 2020.

The overall impression is that the Ukraine government will seize the moment if the pandemic subsides sufficiently, and will attempt to be a 'first mover' in the brave new world.

This report looks at three of the leading airport contenders, should it do that.

TO READ ON, VISIT: Ukraine - Review of potential airport concessions

SPECIAL REPORTS: Aviation Sustainability and the Environment

This regular weekly CAPA report features a summary of recent aviation sustainability and environment news, selected from the 300+ news alerts published daily by CAPA. This week's issue includes: European aviation sector launches 'Destination 2050' net zero emissions strategy; S&P Global Dow Jones Index recognises LATAM Airlines as South America's most sustainable carrier; Edmonton Airport: WeFaces Technology to open solar facility at Airport City; Clean Sky makes progress with PERF-AI, using AI to optimise flight trajectories and reduce emissions; SAP Concur: Nearly half of corporate travellers lack information on sustainability in travel.

TO READ ON, VISIT: SPECIAL REPORTS: Aviation Sustainability and the Environment