Australian airline improvement derailed once again

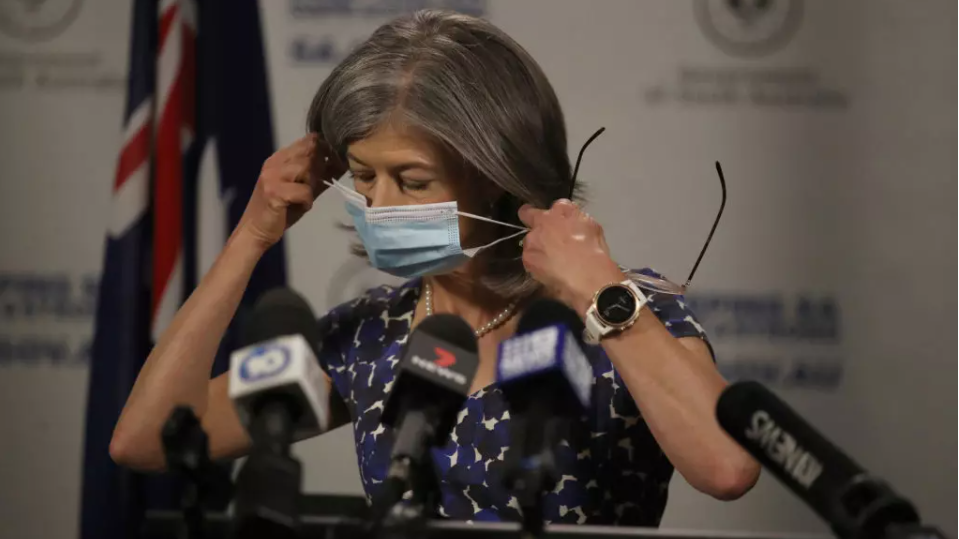

The latest surge of COVID-19 cases in Australia is proving a cruel blow to local airlines that were beginning to recover some momentum based on domestic strength. Now, as annual earnings season approaches for Australasian airlines, the airlines are assessing the fallout from the new wave of infections.

While New South Wales is still the most severely affected, cases are causing restrictions in other states too. This has ramifications beyond Australia's border, as the suspension of the two-way trans-Tasman bubble is causing some economic pain for Air New Zealand as well.

The short term outlook is bleak for Australia's airlines as the latest wave shows no evidence of slowing - in New South Wales at least. Lockdowns and interstate travel restrictions are causing airlines to cut back capacity, change plans - again, and stand down employees in some cases.

One thing that has not changed is that vaccination programs are the key to recovery for airlines. This is certainly the driver for Australia to activate its roadmap for reopening its international borders.

With no end to the current wave in sight, vaccination rates may also be vital to regaining airlines' hard-won progress in domestic markets.

TO READ ON, VISIT: Australian airline improvement derailed once again

American Air and JetSMART usher in change for Latin America

When Indigo Partners managing director William Franke declared during CAPA Live in Jul-2021 that possible tie-ups between ultra-low cost carriers (ULCCs) and full service operators could emerge in a post pandemic world, he may have had something in mind.

The South American ULCC operator JetSMART, which is owned by Indigo, and American Airlines have now declared their intent to forge a partnership that includes codesharing and American's proposal to take a minority stake in JetSMART.

And as that relationship starts to take shape, Delta and LATAM Airlines Group are stressing the importance of their proposed JV as a counterbalance to what they deem as American's dominance in the region.

TO READ ON, VISIT: American Air and JetSMART usher in change for Latin America

Aircraft order backlogs remain intact for Asia-Pacific LCCs

Before the COVID-19 pandemic arrived, one of the most significant trends in the Asia-Pacific region was the vast number of narrowbody orders placed by LCCs. With the industry now in its worst-ever downturn, the future of these orders is a key question for a wide range of industry stakeholders.

For the LCCs themselves, the orders - and more importantly their delivery timetables - present extra headaches as their growth assumptions and financial conditions have changed considerably since the orders were placed.

Competitors will also be watching closely to see if delivery adjustments mean changes in expansion strategies. And the stakes are high for manufacturers and lessors, as the Asia-Pacific LCCs dominate their narrowbody order books.

Plenty of industry observers were sceptical that the Asia-Pacific airline industry could absorb the number of orders racked up by the LCCs in recent years, and such views will be exacerbated by the COVID-19 crisis.

So far there have been no major narrowbody order cancellations or airline collapses among the LCCs with the largest order books. While some have signalled that they remain committed to their narrowbody orders, most have had to negotiate delivery slowdowns of varying degrees.

TO READ ON, VISIT: Aircraft order backlogs remain intact for Asia-Pacific LCCs

Barcelona Airport to become an 'intercontinental hub'

In most other European countries there might be a rivalry between the airport serving the capital and the main provincial one servicing the principal commercial city. And especially so when the provincial one also serves a distinct region that many would like to see be a separate country in its own right.

But not in Spain, where Madrid and Barcelona airports are under common ownership. AENA has recently proposed capital expenditure of EUR1.6 billion and EUR1.7 billion for those airports respectively, and in the case of Barcelona the objective seems to be to turn it into an alternative intercontinental hub in Spain.

But is that really necessary as Madrid's Barajas Airport already serves that function? The rationale is not clear.

Nor is it certain that what the politicians envisage to become "the greenest airport in Europe" can actually be expanded, because doing so would create a real, live, green issue.

TO READ ON, VISIT: Barcelona Airport to become an 'intercontinental hub'

SPECIAL REPORTS: Aviation Sustainability and the Environment

This regular weekly CAPA report features a summary of recent aviation sustainability and environment news, selected from the 300+ news alerts published daily by CAPA. This week's issue includes: easyJet introduces new cabin crew and pilot uniforms made from recycled plastic bottles; Bristol Airport and easyJet enter sustainability collaboration; S7 Airlines launches education programme and incentives for sustainable travel; Avports and REVO ZERO to offer zero emissions vehicles solutions, services to airports; Aruba Queen Beatrix International Airport to launch sustainable waste management projects.

TO READ ON, VISIT: SPECIAL REPORTS: Aviation Sustainability and the Environment