PANYNJ authorised in late Sep-2019 a new strategic plan for Stewart International. A major part of it is entering into a 10-year management agreement with 'Future Stewart Partners', a joint venture between Groupe Aeroports de Paris (Groupe ADP) and AvPORTS Management, which will include an expanded scope for the building of a modern concession programme and collaboration with the Port Authority on attracting new air service to Stewart.

This is but one example of how PANYNJ, without actually becoming a privatised entity itself, is entering into agreements with the private sector. Elsewhere, at the most striking example, LaGuardia airport, a consortium, led by the Vantage Airport Group has completed the first stage of the USD5.1 billion redevelopment project of terminal B under a public-private partnership (P3). Separately, Delta Air Lines has its own USD3.9 billion project for four concourses.

At Newark Liberty International airport, the new Terminal 1, scheduled to open in 2022, is another P3 project, and its management has been turned over to Munich Airport International GmbH. Meanwhile, at John F Kennedy International airport, a USD13 billion plan to redevelop it into a "modern 21st century airport" with two new international terminal complexes on the airport's north and south sides will include USD12 billion in private funding.

Returning to Stewart International, actually Groupe ADP is not itself yet fully privatised. It is majority-owned (just!) by the French state, with a number of minor investors including the Schiphol Group (a cross-shareholding), Vinci and Predica, together with a raft of institutional investors. The intention is that the state will sell its share, probably to one of more of these existing investors, but there is a referendum procedure underway which could block it. Groupe ADP is or has been involved in the operation of almost 40 airports on five continents.

AvPORTS Management is a management services company and operator of smaller airports in the US, usually general aviation but sometimes commercial airports, with over 90 years experience. It's most recent deal (Aug-2019) saw it selected, in a consortium, to be private investor and equity provider in the new all-cargo and perishable goods airport to be located at the current general aviation Airglades airport in South Florida.

Other Details of the Stewart plan include:

- Modernise the air carrier incentive programme to attract and retain new carriers and expand service to new markets;

- Leverage partnerships with regional and state agencies and work with tourism and trade organisations to promote the airport as a driver of economic activity;

- Hire a marketing firm to increase the airport's visibility in both the international marketplace and in the Hudson Valley region, and to strengthen the airport's brand;

- Develop a joint marketing strategy with key businesses and attractions in the Hudson Valley to promote the airport.

PANYNJ chairman Kevin O'Toole says the new strategy will enable the airport to "plan for continued growth" and demonstrates "the airport's unique international capability, market positioning, and proven viability as a low cost alternative for the New York and New Jersey metropolitan region". How much of that stands up to scrutiny?

The Blue Swan Daily last examined Stewart in Feb-2018. At that time, it had just been renamed with the city forming the prefix. The thrust of the article was that having been a notable failure of the 1996 Privatisation Pilot Programme (National Express exited seven years into a 99-year lease and it reverted to public control [PANYNJ]), Stewart had moved on, had attracted European long-haul low-cost specialist Norwegian Air, and was growing rapidly. The question was - could it now be a viable private sector operation?

https://corporatetravelcommunity.com/do-private-entities-now-regret-having-ignored-stewart-airport-now-it-is-set-for-official-new-york-status/

In a way the 'private sector' part will be satisfied by this deal. Groupe ADP and AvPORTS will jointly operate the airport (AvPORTS already manages it, along with others in the locality including Westchester County - which has been subject to a rejected attempt at privatisation - and the aforementioned Teterboro airport in New Jersey). Exactly what, if any, investment will be required is not yet clear but it seems that it is purely a management contract, one that Groupe ADP will be familiar with in several countries dating back to when it was 'Aeroports de Paris'.

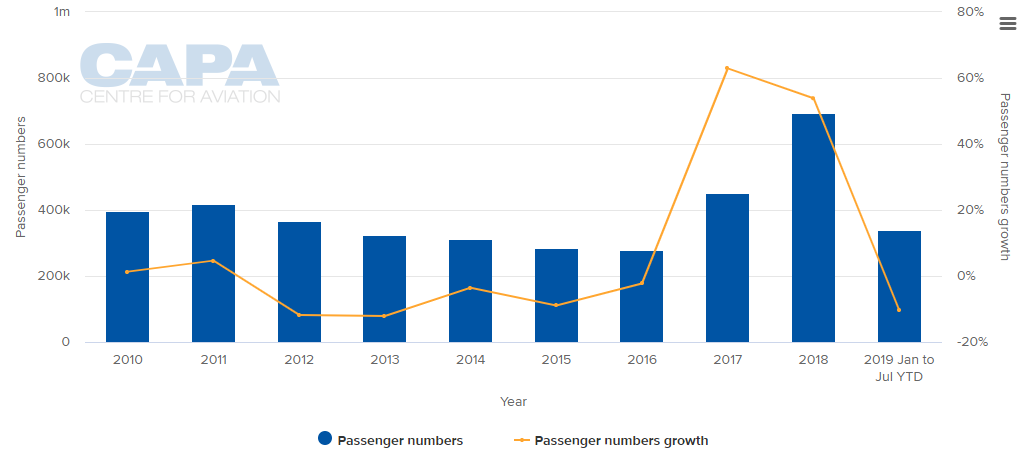

As to whether it will be a viable operation, well things have changed since the previous article. After trundling along with negative growth in all but two of the years from 2009 to 2016 it soared in 2017 and 2018 (+62.9% and +53.9% respectively) with the arrival of Norwegian which served it from five cities in Scandinavia the UK and Ireland.

CHART - New York's Stewart International airport saw passenger levels boom in 2017 and 2018, but the loss of trans-Atlantic air connections this year has seen annual growth levels enter negative territory Source: CAPA - Centre for Aviation and PANYNJ

Source: CAPA - Centre for Aviation and PANYNJ

But, partly due to its financial circumstances and partly due to the grounding of the Boeing 737 MAX Norwegian has now gone, possibly never to return. Traffic is down by over -10% in 1H2019 and what remains is all domestic (American Airlines, JetBlue Airways, Delta Air Lines and Allegiant Air), in a roughly 50:50 full service/low cost split.

A new facility for the federal government to conduct customs and immigration inspections that is scheduled to be completed at Stewart next year could end up being a white elephant as the entire long-haul low-cost segment's viability is again questioned with Stewart unlikely to attract trans-Atlantic FSCs such as British Airways or Lufthansa.

For all the big thinking at PANYNJ, if AvPORTS and Groupe ADP like challenges they've certainly got one here.