The termination came less than a year after CAI/SNS were awarded a 20-year contract to operate the Jeddah airport, a significant contract even for CAI and more so for SNS. The consortium was weighted CAI 75%: SNS 25%. No reason has yet been given for it. The consortium claimed it had "strictly observed the Request for Proposal process. The termination notice was issued as the consortium was in the process reviewing its call for proposals for food and beverage operators, for which it said it had received "overwhelming response".

CAI is an experienced operator, with numerous management contracts and concession arrangements in Asia, Russia and Brazil. It came into being after its predecessor, SCAE (Singapore Changi Airport Enterprise) sold its stake in London Luton Airport to focus on Asian Pacific investments in 2004, setting the scene for CAI to focus initially on Asia, though it subsequently expanded its ambitions geographically. CAI is listed in the CAPA Global Airport Investors Database as a 'Major Global Investor', one of only 57 such organisations worldwide.

The wholly Saudi-owned Saudi Naval Services, or Saudi Naval Support Company as it is also known, is among the most diversified companies in the Kingdom, and active in construction, operations and maintenance, support services and telecommunications and it has undertaken work for GACA previously. It is possible, although this is only speculation, that the problem lies with SNS rather than CAI, despite SNS being the minority shareholder and that it is somehow connected with the power struggle within the Kingdom which began in late 2017 and which has directly affected many institutions there.

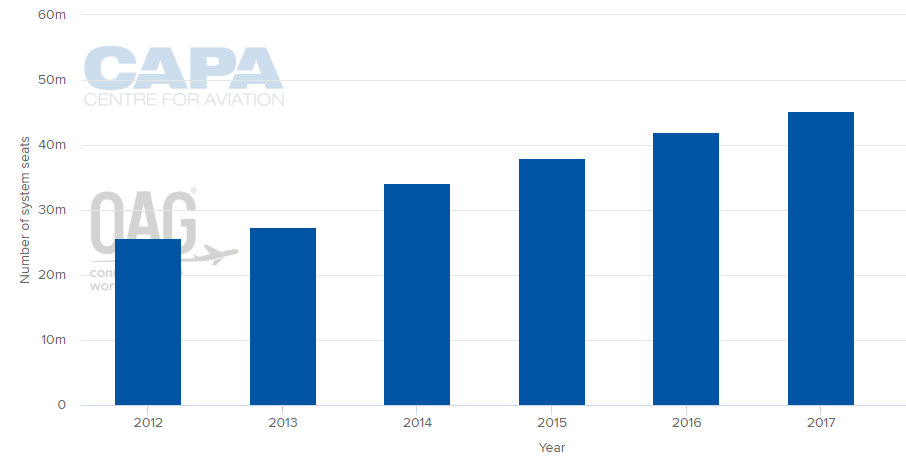

CHART - The growth in system capacity at Jeddah's King Abdulaziz International Airport highlights the continued emergence of the aviation sector in Saudi Arabia's increasingly diversified economy Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Saudi Arabia is one of few Middle Eastern countries that are engaging in an airport privatisation process, one that began in 2016 and which is part of a broader privatisation drive. That was triggered by the fall in the oil price to USD35 a barrel. The country is no longer "oil-rich" despite a rally in prices since then and with oil revenues accounting for 80% of budget revenues diversification was essential.

The government has actually been pursuing economic reform and diversification, particularly since Saudi Arabia's accession to the World Trade Organisation in 2005, attempting to vary revenues, for example by encouraging rather than discouraging tourism, and has been promoting foreign investment in the kingdom.

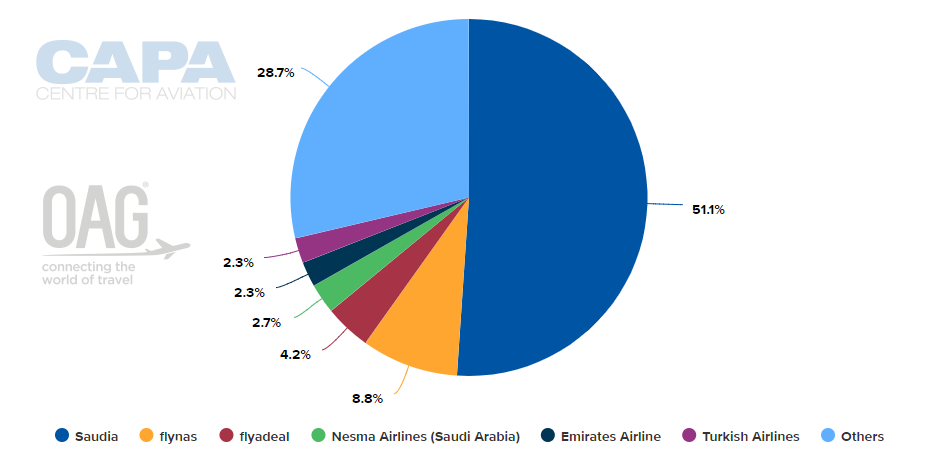

CHART - Saudi Arabia has taken a more liberal approach to airlines in recent years, but national carrier Saudia continues to dominate with its new sister LCC flyadeal also quickly expanding Source: CAPA - Centre for Aviation and OAG (data: w/c 26-Feb-2018)

Source: CAPA - Centre for Aviation and OAG (data: w/c 26-Feb-2018)

The airport privatisation process began with the King Khaled International Airport in Riyadh, with the privatisation of the Jeddah and Dammam airports targeted for conclusion in 2017 (a slight over-run has occurred), with domestic and local airports expected to follow between 2018 and 2020.

GACA had "trialled" airport privatisation before then, with a Build-Operate-Transfer contract for a new airport in Medina signed with Turkish operator TAV Airports, in a consortium with two Saudi companies, Saudi Oger Limited and Al Rajhi Holding Group, in 2011. Later, it chose the same consortium to develop and operate airports in Yanbu, Qassim and Hail. Thereafter, a management contract to operate a new terminal (5) at Riyadh airport was awarded to Dublin Airport Authority in 2016.

Reasons why the privatisation process has been slow include the fact that all the airports had to be corporatised (i.e. made into companies) first, and then transferred to companies owned by the Saudi Civil Aviation Holding, before moving to the Public Investment Fund. Arrangements must also be made for the transfer of employees to the investor.

Moreover, differing methods of privatisation were considered. It seems the public-private partnership has become the preferred method. Despite the forthcoming IPO on the national oil giant Saudi Aramco, IPOs are not known to have been seriously considered for the airports, despite that option being examined.

LEARN MORE: A review of the Saudi airport privatisation scenario was published by CAPA- Centre for Aviation in Feb-2016 and much of it remains relevant: Saudi airport privatisation ramps up as oil prices continue to fall