New research from Your.Rentals, a software platform for short-term rental property managers, has identified the opportunities and perceived struggles of the short-term rental industry, most notably highlighting how technology and digitalisation have helped provide a way for property managers to advertise to a wider audience.

The 'Vacation Rental Industry Report 2020 - what's on the mind of rental managers today?' study of survey findings from 500 property managers, who cover over 3000 properties worldwide, shows that more than eight in ten (85%) property managers believed the rise of online booking platforms like Airbnb, Booking.com, and HomeAway, has been good for those working within the industry.

Major online travel agencies like Booking.com, Expedia and TripAdvisor are now stepping up their rental inventories to compete with Airbnb and Google has become more active in the short-term rental field, the vacation rental industry. This is expected to boost sector revenues worldwide to over USD85 billion in 2020 worldwide. Further growing at a rate of just over 3.5% per year would grow industry revenues beyond USD100 billion by 2024.

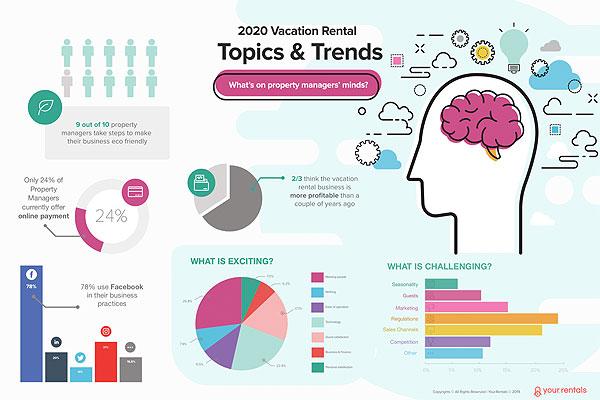

Almost 93% of rental managers feel that the industry is now more competitive than it used to be, but three in four (75%) said the industry is more complicated than the past with new policies that have been implemented making their own business more difficult.

But, the fact that just over half of property managers surveyed (51%) did not have their own websites for their properties, highlights the important role these booking platforms are playing. The value is also clear when you also consider that of the 49% who do have their own website, more than half (55%) don't have any online booking capabilities. A further fifth (21%) are able to capture bookings, but not online payments.

The research also found that in Europe, over a third of property managers do not use property management software or a channel manager, while a quarter of property managers also face challenges in understanding and catching up with the government regulations. But, technology is exciting the rental industry, with one in five managers believing modern technology presented new opportunities or would made specific tasks easier.