The consensus is that the figure will be somewhere around 5% to 10%, but some estimates put it as high as 15%. The true scale of the loss may be difficult to measure as ultimately business travel spend will grow as population and economic influences change and cloud the figures.

Business travel is the foundation of the travel sector and an essential ingredient of any airline's business model, but that certainty comes with a caveat: adaption to new technology could change how we approach corporate meetings in the future. It could also be the undoing of some airlines that have been reliant on its premium clientele to deliver revenues, in the short-term, at least.

As William (Bill) Franke, managing partner of airline investor Indigo Partners recently noted, any company that is skewed to business travellers will ultimately be behind the recovery of the ULCC and LCC operators.

The global business travel sector is expected to take an USD820 billion revenue hit this year, USD190 billion in Europe specifically and right now there is limited co-ordination between countries. Quarantine requirements could add 14 day lockdowns at each end of any journey, and even if travellers are freely permitted from accessing a country via so-called bubbles, previous travel could ultimately force them to comply with entry restrictions.

This all makes technology a more attractive option right now, but when it comes to leisure travel you are not going to holiday via these platforms so we can still expect an pent up demand once restrictions start to ease. But, having faced lockdowns and travel restrictions this is all generating a situation where 'fear transcends desire," says nation and city branding and marketing specialist, Bloom Consulting.

In a recently published report 'Covid-19: Impact on Tourist Behaviours' that brought together an international survey of 4,000 travellers with global online searches from its Digital Demand software, it highlighted some necessary changes that will need to occur in both tourism and the economy sector, as well as how perceptions will change as the pandemic unfolds over time.

The biggest impact on traveller behaviour was identified as the increased fear to travel. Its survey highlighted that some 45% of travellers would not travel for leisure in the next 12 months if Covid-19 is simply controlled, but remains part of our lives; falling to 35% even if it is nearly eradicated and a treatment is found; and still 15% even if it is fully eradicated.

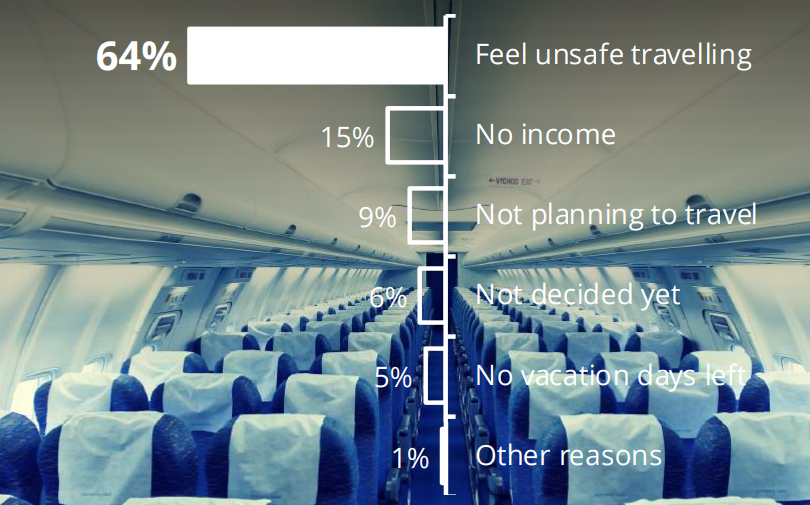

Less income has been suggested as having a major impact on travel sentiment and while the reduction of disposable income is a major consequence of this crisis, it will not be the main reason for less tourists. Each traveller that responded to any of the three above scenarios saying they will not travel claimed feeling unsafe as the overarching reason why. This suggests ultimately that fear of catching the coronavirus has taken precedent over the desire to travel for leisure purposes.

CHART - Feeling unsafe is by far the main reason for travellers refusing to travel, a long way ahead of factors such as lack of income Source: 'Covid-19: Impact on Tourist Behaviours' from Bloom Consulting

Source: 'Covid-19: Impact on Tourist Behaviours' from Bloom Consulting

"This dynamic becomes the ultimate challenge for tourists and destinations," says the report, however, it foresees this effect only having short-term implications and would see a transition to what is perceived as a safer destination rather than a cancellation of travel. It suggests that the way travellers perceive government actions and how effective they were in dealing with the crisis will affect their willingness to visit the country.

The current crisis "will take time to pass and the damage will be overwhelming," says Bloom Consulting, and it offers four recommendations for destinations to incorporate into their structures:

- avoid competing over price - less crowded destinations and improved healthcare systems are tourist's main concerns;

- redesign and redefine the tourism offer - make sure the brand strategy emphasises that the destination is appealing and safe and the product offer must be adjusted to tourist's new expectations and needs;

- broaden your scope influence and data - government action is at the core of how destinations are perceived and will play a leading role in its promotion;

- adapt your current structure - it is essential for DMO's to have a team or a plan in place that is ready to adapt, analyse and respond to a new normal or any arising crises.

But, above all, as the report highlights, ahead of the arrival of Covid-19 the tourism industry was facing structural problems that had to be addressed. "This is a once in a lifetime opportunity. We may not have another chance to rethink and redesign the tourism industry," it says, regardless of how the 'new normal' appears.