In a mirror image of what easyJet is doing with its new Austrian business (see: 'easyJet selects Austria as home for new 'European' airline that will ease any Brexit concerns'), Wizz Air could need a UK registered airline to maintain its flights in and out of the country. As a Hungarian company, Wizz Air will be able to maintain flights within the EU after Brexit, planned in March 2019, but its flying rights into the UK are less clear and could be subject to significant impact.

In an interview this week with Reuters, the airline's chief executive officer Jozsef Varadi explained the current uncertainty meant that plans may need to be put in place to protect its flights. "If there is not an arrangement, then we are going to put contingencies in place, and one of those contingences is that we are looking at establishing Wizz Air as a United Kingdom-licensed airline," he said.

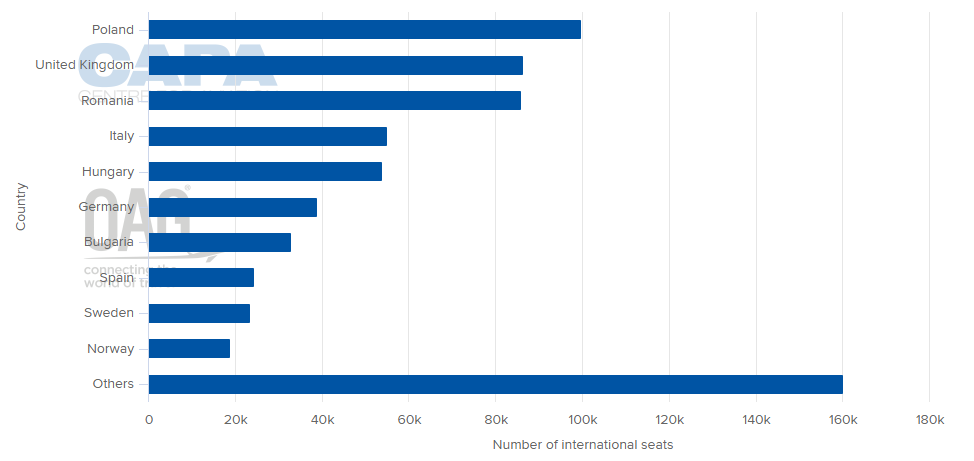

CHART - Largest Wizz Air Country Markets (weekly departure seats) Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

While the focus of the Wizz Air business model is on markets across Central and Eastern Europe, the UK has become a key destination market to facilitate demand. It is currently the second largest country market in the airline's network, accounting for 12.7% of its departure capacity. It serves nine points in the UK (London Luton, Doncaster Sheffield, Bristol, Aberdeen, Glasgow, Belfast, Liverpool, Birmingham and London Gatwick) across a network of 86 routes from Continental Europe and has grown its capacity in the UK by 181.0% since the start of the decade with year-on-year growth of 18.1% in 2014, 32.3% in 2015 and 30.6% last year. It is forecast to grow 10.2% in 2017, based on published schedules.

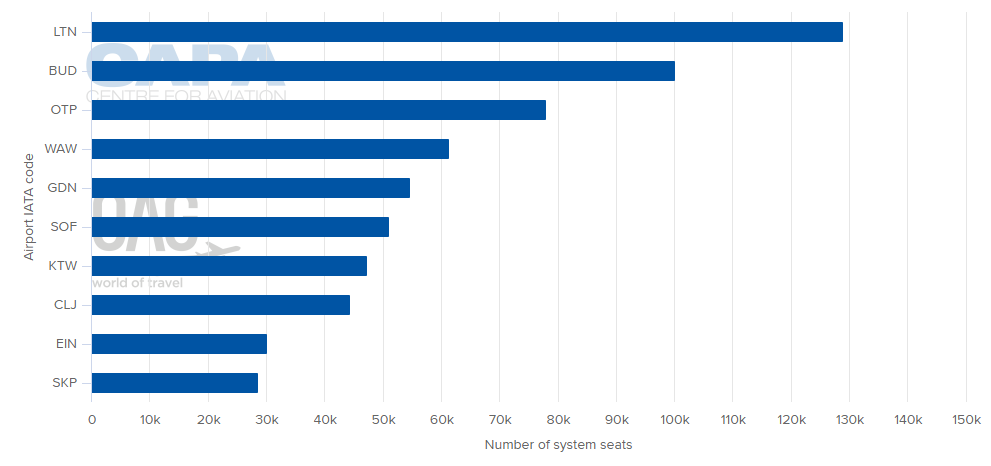

CHART - Largest Wizz Air Airport Operations (weekly departure seats) Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

Wizz Air first introduced flights to the UK in 2004 and London Luton has been a pivotal part of its model and the largest point on its network. With a total operation now encompassing over 40 destinations in almost 20 countries, London Luton accounts for more than a 10% share of Wizz Air's total network capacity, ahead of its developing bases in Budapest, Bucharest, Gdansk, Warsaw and Katowice.

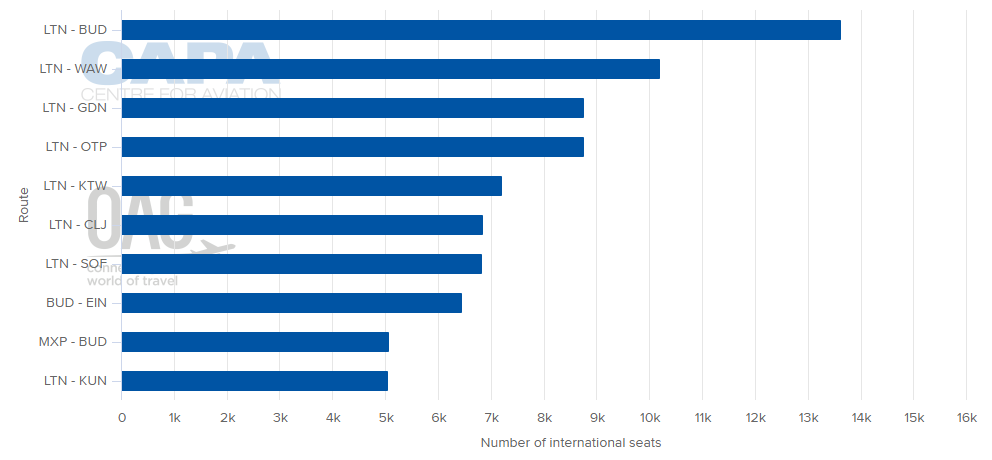

CHART - Biggest Wizz Air Routes (weekly departure seats) Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

This year's network growth and increased frequency on many existing routes mean it is offering more than three million seats from the airport for the first time ever. In fact its seven biggest markets by capacity are to or from London Luton, with eight of the ten routes involving the UK airport.

Wizz Air has continually served London as a destination often using it to facilitate 'W-pattern' operations into additional markets. It finally established a base at London Luton Airport in June 2017 alongside launching new routes to Kutaisi, Pristina and Tel Aviv, the initial steps in what could become a UK domiciled airline and a vehicle to retaining its strong UK operations. It is already utilising the based aircraft to modify its schedules, reducing reliance on 'W-pattern' flying and taking advantage of new early morning slots out of the UK capital.

With Ryanair's often spoke about doomsday scenario pulling much of its summer 2019 UK schedule, easyJet's new Austrian venture and now Wizz Air's march into the UK, the threat to the aviation from Brexit is clear to see. Unlike other industries, aviation has no fall-back option if the UK and EU fail to reach an agreement.

In other sectors, trade would be conducted under World Trade Organisation rules, even if such a scenario is not ideal. However, aviation is not part of the WTO. In the absence of an EU-UK agreement on aviation, airlines could possibly lose traffic rights and be unable to fly between the two markets: a so-called "cliff-edge" scenario.

Airline companies are seeking ways to address this problem and avoid this scenario through establishing new operating companies and considering ownership structures. In this respect, airlines are following a long tradition in the sector of innovating to circumvent regulatory barriers. However, this is an unwelcome distraction, and still risks stumbling over the bureaucratic uncertainties ahead.

In an insight into the matter CAPA argues this so-called "cliff-edge" scenario must be avoided and if necessary, "a transition period" maintaining UK access to the single aviation market should be agreed in order to give more time for a longer term solution. "Negotiators in the UK and the EU must prioritise the aviation sector and give much-needed clarity as a matter of urgency," it says.

READ MORE: Brexit: easyJet seeks Austrian AOC to preserve traffic rights; highlights dark cloud over aviation

Wizz Air celebrated its 13th birthday on May 19, 2017 a period during which it has grown to be the biggest airline in Central and Eastern Europe (excluding Russia and Turkey), with a compound average growth rate in ASKs of 24%, and in passenger numbers of 23%, over the past ten years. In summer 2017, and across its financial year to March 2018, Wizz Air is accelerating its growth rate. Alongside this impressive growth, it has also established a track record of healthy profitability and was rewarded with the CAPA LCC of the Year award for 2016.