Summary:

- LCCs took the lead in Italy in 2017 and secured a 50.9% of the Italian aviation market in 2017, an increase of +9.27% and first time the model has handled the majority of passengers in Italy over legacy airlines;

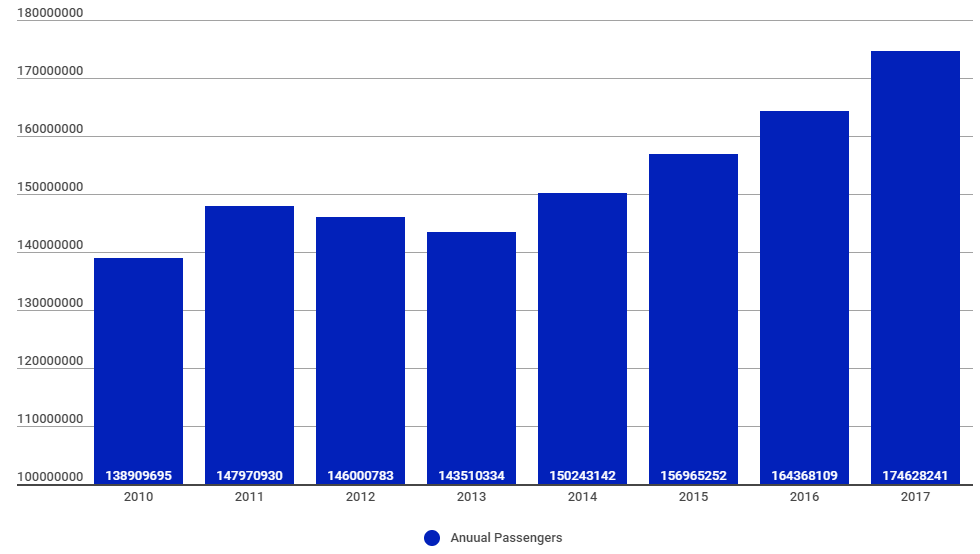

- A total of 174 million passengers were handled by the Italian aviation sector in 2017, up 10 million passengers or +6.23% year-on-year;

- Ryanair, Alitalia and easyJet are the market leaders in the Italian aviation market, while five of the top 10 airlines in terms of airline capacity in Italy are pan-European LCCs;

- Success of pan-European LCCs raises serious questions over Italy's own airlines and especially the rebirth of Meridiana as Air Italy and ongoing delays formalising a new investor for Alitalia.

Italy's national carrier Alitalia has operated under special administration since early 2017. The airline has only been able to conduct usual business due to a series of outrageously exorbitant financing instalments by the Italian Government, which now total EUR900 million.

Furthermore political parties Five Star Movement (M5S) and Lega Nord are scrambling to form a new Government, in what will become an amalgamation of populist and far right-wing stances. The parties are advocating for increasingly protectionist legislative arrangements - including a potential Italian Government exit from the European Union.

But despite this uncertainty, the Italian aviation industry as a whole continues to prove its robustness with 174 million passengers travelling in 2017, an increase of over 10 million passengers or +6.23% year-on-year.

CHART: After small dips in 2012 and 2013, the Italian aviation market has added over 30 million passengers from 2013 to 2017 Source: The Blue Swan Daily and ENAC

Source: The Blue Swan Daily and ENAC

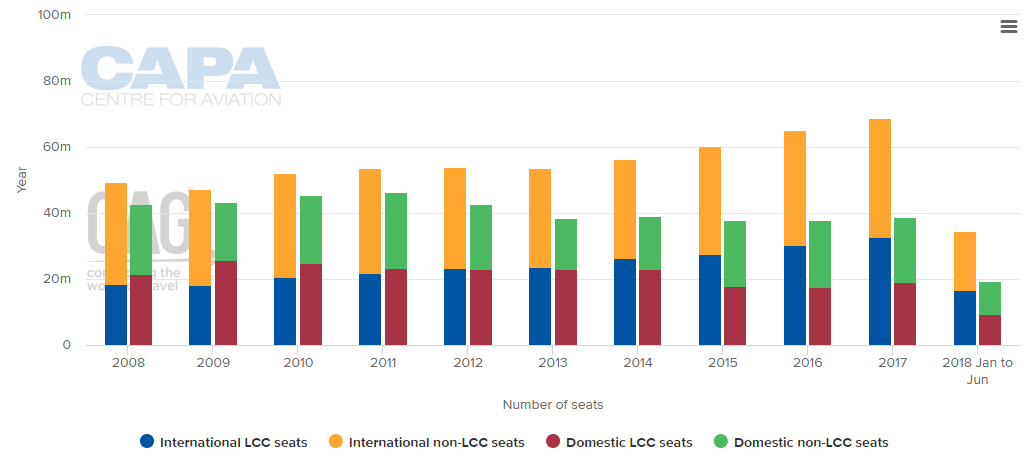

According to the latest market activity assessment by the Italian Civil Aviation Authority, this growth has been largely buoyed by LCCs - specifically with the emergence of pan European LCCs. LCCs accounted for 50.9% of the Italian aviation market in 2017, an increase of 9.27% and marking the first time the business model has handled the majority of passengers in Italy over legacy airlines. Legacy airlines handled 85.8 million passengers, though also managed to grow, albeit at a rate of 3.28%.

CHART: The rise of LCCs in Italy's international market is clear, but the sector has actually contracted in domestic skies Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

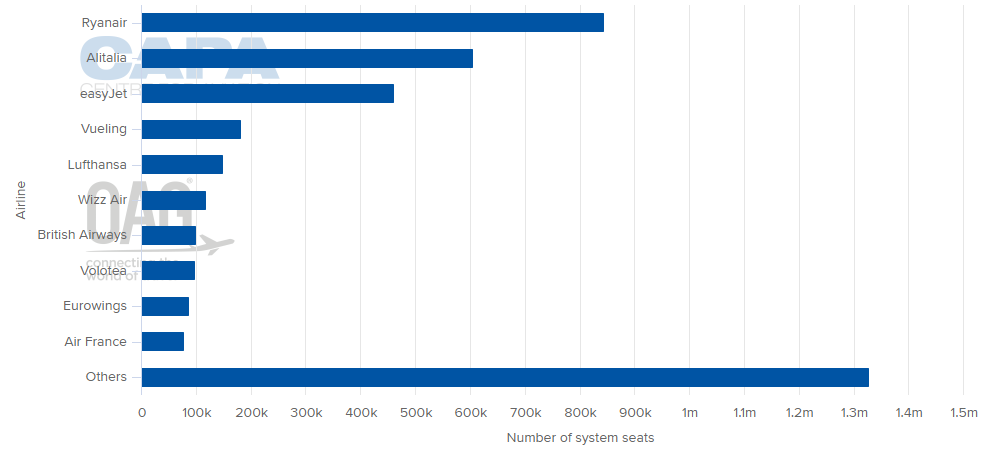

As confirmed by CAPA - Centre for Aviation data, Ryanair, Alitalia and easyJet are the market leaders in the Italian aviation market, while five of the top 10 airlines in terms of airline capacity in Italy are pan-European LCCs (Ryanair, easyJet, Wizz Air, Volotea and Eurowings - Vueling is also an LCC but not really considered pan European with limited operations outside of its home Spanish market)

CHART: Five of the top ten airlines in terms of system capacity in Italy are currently pan-European LCCs, namely Ryanair, easyJet, Wizz Air, Volotea and Eurowings Source: CAPA - Centre for Aviation and OAG

Source: CAPA - Centre for Aviation and OAG

While the Italian airline sector clearly suggests LCCs will continue to dominate, the creation of Air Italy in early 2018 is symbolic of a new wildcard which could see a complete rework of the sector's market share. Air Italy is a rebrand of Italian carrier Meridiana following Qatar Airways Group acquiring a 49% stake in the carrier. The other 51% is owned by Alisarda, Meridiana's original owners.

Air Italy operates a fleet of just 14 aircraft, but its growth plans are beyond ambitious. As part of a wider business plan to grow to operate 50 aircraft and handle 10 million passengers by 2022, eight new aircraft will be added to the fleet in 2018, including three Boeing 737 MAXs and five A330-200s.

https://corporatetravelcommunity.com/are-the-sands-of-time-running-out-for-alitalia-following-qatar-induced-air-italy-rebirth/

Qatar Airways Group CEO Akbar Al Baker, speaking at CAPA's Airline CEOs in Sydney event, stated the investment in Air Italy is a direct response to the "huge market" in Italy and the lack of a "strong national carrier". Mr Al Baker also suggested one of Qatar Airways' equity partners may want to take a stake in Air Italy in future.

A platform for the growth of Air Italy is a recently signed codeshare with Qatar Airways, which entered effect on 24-Apr-2018. Qatar operates 42 weekly services between Doha and Italy, and Air Italy will codeshare on each one of these routes. The reciprocal nature of the codeshare also means Qatar Airways gains a moderate presence in the Italian domestic market, with the carrier's code now present on routes including Milan Malpensa-Catania, Milan Malpensa-Rome Fiumicino, Milan Malpensa-Naples, Milan Malpensa-Olbia, Milan Malpensa-Palermo, Milan Malpensa-Reggio Calabria and Olbia-Rome Fiumicino.

The question is - Does Italy really want or need a strong national carrier? As of now, it seems travellers are quite content with pan-European LCCs and strong, already well-established brands being the primary source of traffic.